As a property investor, you know that maximising your returns is key to your success.

One way to do this is by taking advantage of tax depreciation, which allows you to claim deductions for the wear and tear of your property over time.

But with two depreciation methods to choose from – prime cost or diminishing value – which will help you maximise your savings?

In this article, we’ll explain how each method works, so you can make an informed decision and maximise your tax savings.

What is the Prime Cost Method?

The prime cost depreciation method, also known as the straight line depreciation method, calculates the decrease in value of an asset over its effective life at a fixed rate each year.

The Australian Taxation Office (ATO) determines the effective life, which is the number of years that the asset is expected to be used or have a useful life.

The prime cost formula is as follows:

Asset’s cost x (days held ÷ 365) x (100% ÷ asset’s effective life)

So, if an asset costs $50,000 and has an effective life of 10 years, you can claim 10% of its cost in each of the ten years:

$50,000 x (365 ÷ 365) x 10% = $5,000

The depreciation calculations will continue until the remaining value of the asset reaches zero.

How Does the Diminishing Value Method Work?

The Diminishing Value Method is a method of depreciation that allows you to claim a higher percentage of the asset’s cost in the early years of its life and a lower percentage in the later years.

So, the deductible amount will decrease in value each year until the asset value runs out

However, you can increase the claim on items valued below $1,000 using low-value pooling. And for any items valued at less than $300, you can claim 100% of the value of the item immediately.

The diminishing value formula is as follows:

Base value x (days held ÷ 365) x (200% ÷ asset’s effective life)

Using the same $50,000 asset example, here’s how this method would apply to you first year’s deduction:

$50,000 x (365 ÷ 365) x (200% ÷ 10) = $50,000 x 20% = $10,000

For subsequent years, the base value will reduce based on the difference between the current year and the next year. In this example, the base value for the second year of the asset will be $40,000, i.e. $50,000 minus the $10,000 depreciation in value for the first year.

The second year’s deduction is calculated as:

$40,000 x (365 ÷ 365) x (200% ÷ 10) = $40,000 x 20% = $8,000

In the third year, the base value will be $32,000 and the claim will be $6,400.

In the fourth year, the base value will be $25,600, and the claim will be $5,120.

The depreciation calculations will continue until the final value of the asset reaches zero.

Comparing the Two Depreciation Formulas

Here’s how the prime cost and diminishing value method compare based on a year-to-year dollar value depreciation claim change for that $50,000 asset:

| Purchase Price of Asset | $50,000 | |

| Effective Life of Asset | 10 | |

| Year | Prime Cost | Diminishing Value |

| 1 | $5,000.00 | $10,000.00 |

| 2 | $5,000.00 | $8,000.00 |

| 3 | $5,000.00 | $6,400.00 |

| 4 | $5,000.00 | $5,120.00 |

| 5 | $5,000.00 | $4,096.00 |

| 6 | $5,000.00 | $3,276.80 |

| 7 | $5,000.00 | $2,621.44 |

| 8 | $5,000.00 | $2,097.15 |

| 9 | $5,000.00 | $1,677.72 |

| 10 | $5,000.00 | $1,342.18 |

| Total Depreciation | $50,000.00 | $44,631.29 |

Here’s another example of how the two formulas compare with an $80,000 asset:

Which Depreciation Method Should I Use for My Property?

Both methods claim the same total depreciation value over the life of the asset.

However, they use different formulas to calculate depreciation deductions, which can result in different short and long-term cash flow positions for the property investor.

The prime cost method may be more suitable for assets that have a longer effective life, such as buildings, as the depreciation rate is lower.

On the other hand, the diminishing value method may be more suitable for assets that have a shorter effective life, such as plant and equipment, as the depreciation rate is higher in the early years.

Here are some factors to consider when deciding which method will best suit your circumstances, keeping in mind that you must use the same method for the entire asset’s effective life:

How Long Are You Planning to Hold onto the Property?

If you have no intention to sell for the next forty years (this is the effective life of a property asset), then the result for depreciation is the same.

However, unforeseen circumstances do occur, and despite not planning to sell, you may have to.

Are You Using the Property As Your Main Residence or Rental Property?

If you’re living in your property and then decide to rent it out, you may lose the opportunity to claim on depreciation during the period you lived in the property. However, other factors come into play, such as government incentives and grants that may provide more significant benefits, so depreciation might not be a factor.

What is Your Forecasted Tax Situation During Each Financial Year?

If you’re an investor who’s on a low income, you may be inclined to minimise your deductions in the first few years of ownership and take advantage of higher depreciation claims years down the track when you’re potentially earning a higher income.

Inflation

With general prices and the cost of living increasing each year due to inflation, $1 today isn’t worth $1 next year. Therefore, many investors prefer to claim the extra deductions using the diminishing value depreciation method to have the extra money to invest and use as soon as possible.

We recommend that you make this decision with your accountant to ensure all factors are considered before determining which depreciation method is best for you.

Depreciation Formula Comparison: Apartment vs. House Case Study

Our process has always been about being aggressive using the ‘Duo Tax Method’ – yielding a higher claimable allowance for depreciation by digging deeper into the construction make-up of a property.

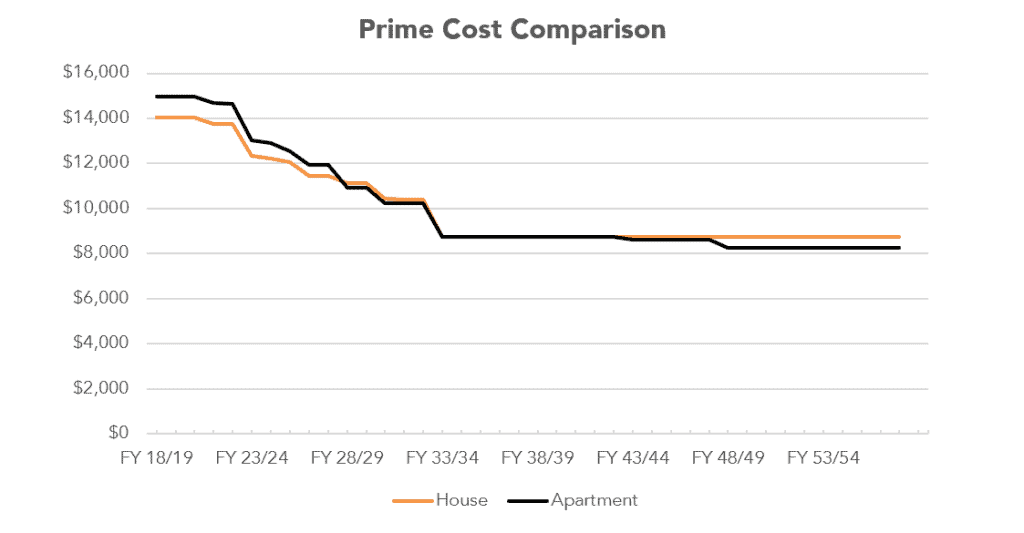

The below graph represents both the diminishing value (DV) method and the prime cost (PC) method applied to each type of property we usually survey:

Here’s another comparison based on a year to year dollar value change for a $50,000 asset:

As you can see, the prime cost depreciation method affords a fixed rate of depreciation. In contrast, the diminishing value method has a more significant upfront deduction in the first four years of the asset.

Before deciding which is better, you’ll need to understand how each formula is calculated:

prime cost (PC) method applied to each type of property we usually survey:

As you can see, apartments (black line) and their assets depreciate faster in the first few years when compared to houses as there is typically much more Plant and Equipment (Division 40) in an apartment than a house.

This is largely due to there being lower gross floor area (GFA – total floor area inside the building) and a higher ratio of fixtures and fittings in an apartment when compared to a house of similar construction cost.

After the first few years though, you can see the two lines slowly converge as plant and equipment is all depreciated.

Strata plant and equipment such as lifts, gyms, pools and tennis courts are apportioned costs with values commonly eligible to be placed into the low-value pool (see below).

The result is an accelerated rate of depreciation and typically higher initial deductions in the first few years.

Other Factors to Consider: Do You Have Assets You Can Add to a Low-Value Pool?

Low-Value Pooling is a method of calculating depreciation value for assets that cost less than $1,000. Instead of calculating depreciation for each asset separately, they are grouped together in a pool and depreciated at a rate of 18.75% per year.

For example, if you have several assets that cost less than $1,000, you can group them together in a Low-Value Pool. If the total cost of the assets in the pool is $5,000, the annual depreciation value would be:

Depreciation = $5,000 x (18.75 / 100) = $937.50

Key Takeaways

Every investor’s situation is different. Whether you’re buying a brand new property, a second-hand property, living in it or renting it out, these circumstances all have a part to play in deciding which depreciation method to use.

Given the complexity of the situation, investors would be wise to discuss their tax matters with their accountant to ensure that they’re getting the most out of tax depreciation for their investment property.

At Duo Tax, our tax depreciation schedules provide both prime cost and diminishing value depreciation schedules. They’re designed for both investors and accountants so that you can determine what’s best for you.

Our ‘Duo Tax’ method focuses on being the most aggressive in depreciation claims, the fastest in turnaround time, and the most affordable tax depreciation schedule.

Our ‘Duo Tax’ method focuses on being the most aggressive in depreciation claims, the fastest in turnaround time (within five business days) and the most affordable.

To purchase your depreciation schedule, call us to get a free estimate on how much depreciation we can claim for you.

Ready to get started?

Talk to one of our friendly property experts to get a free quote or more Information.