What is a Depreciation Schedule: A Beginner’s Guide

Did you know that 70% of investors in Australia don’t buy a tax depreciation schedule for their investment properties?

Depreciation schedules are one of the most effective but underused tools available to a property investor to maximise their returns.

When you think about the fact that depreciation is the second-highest tax deduction on your property after interest on your loan, it’s unbelievable how much investors are leaving on the table.

But what is a depreciation schedule exactly? And how can you benefit from it?

We’ll break down everything you need to know about tax depreciation schedules so that you can maximise the tax benefits available to you through your investment property.

What Is Tax Depreciation?

Before delving into what is a tax depreciation schedule is, it’s important to understand property tax depreciation.

One often under-utilised tool in the investor’s toolkit is depreciation.

Depreciation is a non-cash deduction that allows you to claim a portion of the cost of your property over its useful life. To claim depreciation, you need to order a depreciation schedule from a quantity surveyor.

As a building gets older, its structure and the assets within the building are subject to general wear and tear. In other words, each year, the value decreases and thus, depreciates.

The Australian Tax Office (ATO) allows property investors, who generate income from their investment property, to claim the property depreciation as a tax deduction.

Put simply; depreciation is the decrease in an asset’s value over time due to natural wear and tear. Property depreciation can provide a significant tax benefit for investors, as the Australian Taxation Office (ATO) effectively allows you to offset the cost of this wear and tear against rental income.

What sets a depreciation claim apart from other rental expense tax deductions for your investment property is that it is a non-cash deduction – you don’t have to spend any money to claim it.

The structural component of a building usually depreciates at a fixed rate over a long period of time—usually 40 years. In contrast, plant and equipment assets depreciate according to their effective lives as they generally wear down faster than the building itself.

There are two main types of property depreciation: capital works deductions (Division 43) and plant and equipment (Division 40) deductions.

Investors can claim a capital works deduction for the building itself, as well as plant and equipment depreciation deductions for assets within the building, such as furniture, fittings, and appliances.

Types of depreciation deductions in the space of property investing, namely:

Division 43 – Capital Works Deductions

Division 43 Deductions refer to the depreciation of the structure of the building. The structure of a residential building, if constructed after September 1987, generally has an effective life of 40 years.

You can claim a capital works deduction on construction costs, too.

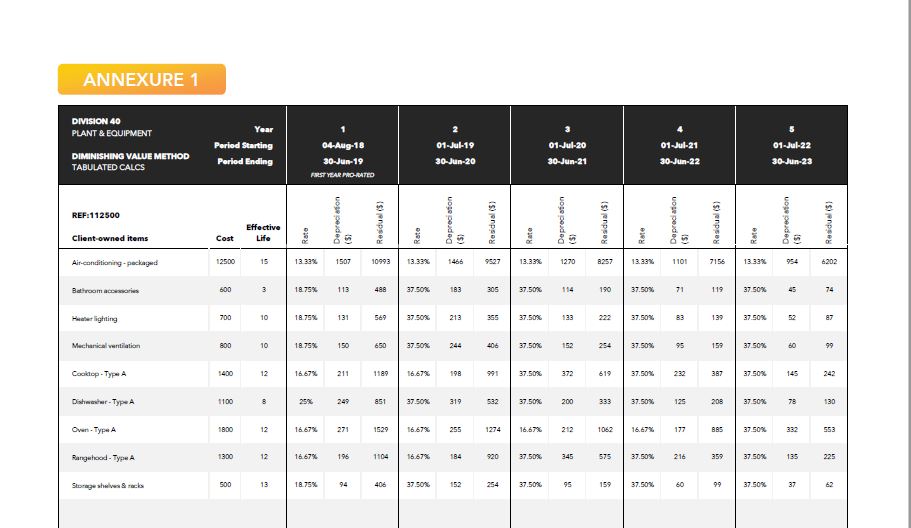

Division 40 – Plant and Equipment

The term “plant and equipment” refers to the fixtures and fittings that are found within the building.

Plant and equipment depreciation on these easily removable assets includes items such as carpets and air conditioning units.

What Are Tax Depreciation Schedules, and How Can They Change Your Tax Return?

Simply put, depreciation schedules are reports detailing the tax depreciation deductions you can claim on your investment property.

Claiming these tax-deductible expenses involves identifying the value of an investment property, what you estimate construction costs to be, and all its fittings and fixtures.

The purpose of a tax depreciation schedule is to outline the value of both your Division 40 and Division 43 assets as well as how much it has depreciated and will depreciate. This will give you a clear idea of how much you can claim for tax depreciation.

A tax depreciation schedule provides a breakdown of the depreciation deductions you can claim for an investment property and eligible plant and equipment assets. It includes the original value, the estimated effective life, and the depreciation rate for both the structural components and the plant and equipment assets.

The tax depreciation schedule document is typically prepared by a professional quantity surveyor who’s a member of the Australian Institute of Quantity Surveyors. Qualified quantity surveyors will inspect your investment property and assign a value to each asset.

Example:

In February 2020, Noel purchased his first investment property for $375,000 and immediately rented it out.

Based on the tax depreciation schedule he obtained from the quantity surveyors at Duo Tax, the construction of his property commenced in March 2003 and was completed in November 2003. The cost of construction was estimated to be $225,000.

The property depreciation schedule outlines that Noel can claim a capital works deduction at a depreciation rate of 2.5% per annum, as the construction of his investment property commenced after 15 September 1987.

In his first year of owning the property, Noel was only able to rent out the property from 1 February 2020 to 30 April 2020, so he can claim a deduction for 90 days:

($225,000 x 2.5%) x (90 days of 366 days in 2020) = $1383.20.

Thus, Noel can claim a capital works deduction of $1383.20 in his 2019-2020 tax return.

As the property was built in 2003, Noel’s tax depreciation report will highlight the capital works deductions he can claim until 2043, provided that he still owns the investment property and it’s being used to produce income.

The tax depreciation schedule report also charts the loss in value of his plant and equipment assets, such as his air-conditioning unit, over its effective life. So, Noel can claim tax deductions for these assets too.

Below is a sample of the depreciation process in Noel’s tax depreciation schedule drawn up by us at Duo Tax:

What Does a Tax Depreciation Schedule Include?

Based on Noel’s example above, a tax depreciation schedule generally includes the following components:

- an introduction to the schedule with a glossary of terms to help you better understand how the schedule works for depreciation purposes,

- a detailed 40-year estimate showing all Division 43 (capital works) depreciable items,

- Examples of both the prime cost and diminishing value methods of depreciation to help you decide which method is best for your individual circumstances,

- the effective life and prescribe depression rate for all Division 40 (plant and equipment) assets, and

- a breakdown of the assets that belong to low-value pools as well as those that qualified for an instant-asset write-off.

You can request a Duo Tax property depreciation schedule report sample here. Our depreciation reports are easy to read and provide clear instructions, giving you a good idea of how your report should look and how to claim depreciation deductions.

How Do You Get a Depreciation Schedule?

Getting your hands on a property depreciation schedule requires you to get in touch with a quantity surveyor.

To satisfy the requirements set by the ATO, the Australian Institute of Quantity Surveyors requires a property inspection before producing the tax depreciation schedule. Quantity surveyors are one of the few professions recognised by the ATO who can estimate a property’s historical and current costs and its included assets.

If you aren’t sure if you’re able to get a tax depreciation schedule, initially contact quantity surveyors to get a free estimate on what they could claim.

At Duo Tax, our quantity surveyors can conduct some preliminary research using real estate data to find out the type of building, when it was built and the estimated construction cost. This way, you can ensure that you’re satisfied with the result of the depreciation report before committing to purchasing a depreciation schedule.

You can also access tools such as a depreciation calculator to help estimate what you could potentially claim before purchasing a depreciation schedule.

After that, a qualified member of their team will come to the property and note all the depreciable items. Following the inspection, you should expect your tax depreciation schedule within two weeks.

A single schedule provides 40 years of claimable deductions (or the maximum entitled years), so you will only have to have your property inspected once.

The bonus here is that the quantity surveyor fees are a property tax deduction!

What Are the Benefits of Depreciation Schedules For Your Investment Property?

Is a Depreciation Schedule Worth It?

The advantages of having a quantity surveyor draw up a tax depreciation schedule for your property is extensive. Some of these depreciation benefits include:

- Making your first, or even your next, property a more desirable and attainable option which will essentially help kick start your wealth-building journey;

- it can be the difference between having a negatively geared property and enjoying an enhanced cash flow;

- Unlike other property deductions, a tax depreciation schedule is a once-off cost, and you can claim depreciation deductions without spending money each financial year; and

- the schedule is tailored to maximise all the benefits available to you under Australian law for new and older properties.

Other FAQs about Depreciation Schedules

How Can You Get Your Hands on an Investment Property Tax Depreciation Schedule?

If you’re looking at ways to get a tax depreciation schedule, the best way is to contact a quantity surveyor.

A quantity surveyor will estimate construction costs, project management, and construction consulting services. They work on various commercial, residential, and industrial projects.

In Australia, however, quantity surveyors are also qualified to draw up a depreciation schedule because of their ability to estimate property costs, including historical costs.

To complete the report, they’ll undertake a detailed evaluation of your property and draw up a schedule you can submit to your accountant as part of your tax return.

The schedule is valid for up to 40 years, which means you can claim tax deductions each year with the same report, and even the quantity surveyor fees are tax deductible.

How Do Quantity Surveyors Calculate Your Depreciation Deductions?

There are two ways to calculate depreciation deductions for your investment property: the prime cost method and the diminishing value method.

The prime cost method calculates the decrease in value of an asset over its effective life at a fixed rate each year. The diminishing value method results in a higher depreciation deduction in the first few years of property ownership, as it considers an asset’s diminishing value as it ages.

Ultimately, the choice of which method to use will come down to factors such as:

- How long you’re planning to hold onto the property

- Your tax situation

- Inflation

You might be interested in reading: Prime Cost vs. Diminishing Value Depreciation Method – Which is Better?

What Do Tax Depreciation Schedules Look Like? What is Included in a Deprecation Schedule?

You can expect a detailed depreciation schedule to contain the following elements:

- Glossary: ATO jargon can be tricky to grasp, so a good depreciation schedule will contain a glossary of terms to help you understand exactly what you’re reading.

- Breakdown of your capital works deductions: You should be able to see how much the structural components of your property have already depreciated and how much it will continue to depreciate.

- The effective life of eligible plant and equipment assets: The depreciation schedule should provide you with an itemised list of all eligible plant and equipment assets on which you can claim a deduction, as well as its prescribed effective life (i.e., how long you can use the item).

- Both calculation methods: You should be able to see how much depreciation you can claim according to both methods so that you can decide what you prefer.

- Low-value pool assets: If you have less than $1,000, you can add them to a low-value pool, which allows you to claim deductions for the pool at a set annual rate.

If you would like to see the exact breakdown, you can request a tax depreciation report sample from Duo Tax.

Do I Need a Depreciation Schedule Every Year?

A single tax depreciation schedule covers a specific investment property and is valid for up to 40 years, which means you can claim tax deductions each year with the same report.

When you purchase another investment property, you will need a separate depreciation schedule for that investment property.

However, if you are looking to sell your investment property, then you will need to have a property valuation carried out by a quantity surveyor to calculate capital gains tax.

What To Do With the Tax Depreciation Schedule After Receiving It?

Following the completion of your tax depreciation schedule, all you have to do is hand it over to your accountant, and they will submit the results in your tax return each financial year.

When Is the Ideal Time to Purchase a Tax Depreciation Schedule?

To maximise your annual deductions, you should order your tax depreciation schedule before the end of the financial year, which is on 30 June.

Even if you haven’t owned your property for an entire financial year, you should still order your depreciation schedule before 30 June of that year so that you can qualify to claim deductions partially and take advantage of instant asset write-offs.

What Sets Duo Tax Apart?

Duo Tax is the best depreciation schedule company. For the past eight years, the team at Duo Tax have helped thousands of property investors maximise their deductions through our depreciation services and the power of tax depreciation reports. As avid investors themselves, their mission is to help all investors get the most value out of their investments.

With over 30 combined years of experience and a nationwide presence, our Duo Tax process focuses on the most aggressive form of depreciation, which means more cash in your pocket.

What’s more, Duo Tax offers free immediate and accurate over-the-phone estimates so you can decide if it’s worthwhile to order a depreciation schedule and submit a depreciation claim. We guarantee you’ll receive your depreciation schedule within ten business days from payment – the fastest in the industry.

Please don’t take our word for it; look at all the amazing Google and TrustPilot reviews.

Key Takeaways

Property investors are usually entitled to tax deductions as part of the wear and tear that occurs on their investment properties.

But so many investors miss out on the opportunity to save thousands of dollars each year because they don’t realise the cash flow benefits of obtaining a depreciation schedule.

A depreciation schedule is a powerful tool that every Australian property investor should utilise. If you’re thinking about investing in property, be sure to speak to a professional quantity surveyor about getting a depreciation schedule for your investment property.

Depreciation deductions can significantly reduce your taxable income and help you realise a positive cash flow sooner. Remember to use our FREE rental property depreciation calculator to estimate how much depreciation you can claim.

Are you one of the 70% of investors who are missing out?

Obtain your tax depreciation schedule from Duo Tax in 3 simple steps:

- Contact us, and we will ask you a few simple questions to see if your property qualifies.

- Order a depreciation schedule over the phone or via our online form, and we will begin preparing your depreciation.

- Within 5-10 business days, your personalised depreciation report will be delivered to you and your accountant.

It’s as easy as that—don’t miss out on an opportunity to save thousands of dollars in tax!

Ready to get started?

Talk to one of our friendly property experts to get a free quote or more Information.