Rental Property Depreciation Calculator

Maximising Tax Benefits with Depreciation

There are various methods to calculate depreciation on investment properties. The two most common methods are the straight-line method, which spreads the cost evenly over the asset's useful life, and the declining balance method, which front-loads the depreciation in the earlier years.

Understanding how to calculate depreciation accurately can significantly impact how you maximise your tax benefits. However, the mechanics of property depreciation can be complex. To ensure you're maximising your tax deductions and navigating the nuances correctly, you should contact a quantity surveyor and organise a tax depreciation schedule.

What is a Tax Depreciation Schedule?

The value of the building and assets within it decreases over their useful life due to wear and tear, which is why the Australian Taxation Office (ATO) allows property investors to claim property depreciation.

To calculate your depreciation expenses and determine the value of your investment property and plant and equipment, a qualified quantity surveyor must inspect your investment property and assign a value to each asset.

A tax depreciation schedule is a comprehensive report that details the tax depreciation deductions you can claim on the value of these assets.

At Duo Tax, our quantity surveyors can conduct some preliminary research using real estate data to determine the type of building, when it was built, the purchase price and the estimated construction cost. This way, you can ensure that you’re satisfied with the result of the report before committing to purchasing a depreciation schedule.

You can also access tools such as our depreciation calculator to calculate depreciation and help estimate what you could potentially claim before purchasing a depreciation schedule.

Our Tax Depreciation Calculator

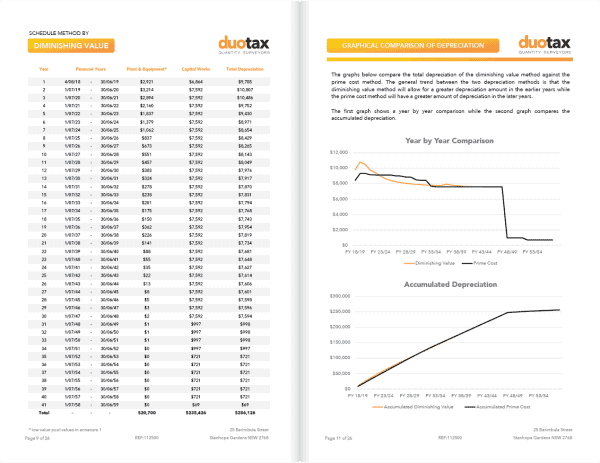

You can calculate your estimates using the straight-line depreciation rate (prime cost) or the declining balance depreciation method (diminishing value).

Once you’re happy with the potential deduction estimates, you can get in touch with one of our quantity surveyors, who will conduct a property inspection to note all the depreciable items. Following the inspection, you should expect your tax depreciation schedule within two weeks.

A single schedule provides 40 years of claimable deductions (or the maximum entitled years), so you will only have to have your property inspected once.

And the quantity surveyor fees are a property tax deduction!

Please note that this is only for indicative purposes and should not be used to claim on your tax return.

Depreciation Calculator

Rental Calculator Frequently Asked Questions

Calculating your annual depreciation involves determining the asset’s cost, its estimated useful life, and the method you’ll use (e.g., straight-line or declining balance). For investment properties, you’ll also need to consider the building’s age, the value of fixtures and fittings, and any renovations. It’s advisable to use tools like a Tax Depreciation Calculator or consult with a quantity surveyor to ensure accuracy and maximise tax benefits.

The Rental Property Depreciation Calculator is designed to provide investors with first-year and second-year estimates of how much they can likely claim depreciation deductions on their residential or commercial investment property. This will give you a good gauge of whether purchasing a tax depreciation schedule is worthwhile.

Alternatively, you can contact us to get a free estimate of your depreciation amount and quote for your depreciation schedule.

The calculator will calculate the depreciation estimate based on a series of data points from our comprehensive database and compare this with similar properties to give you an approximate depreciation value for your investment property.

The ATO prescribes two methods to calculate depreciation.

1. The Prime Cost (straight line) Depreciation Method

Under the prime cost method, also known as the straight-line depreciation, you calculate the decrease in value of an asset over its effective life at a fixed rate each year.

2. The Diminishing Value Method

Under the diminishing value method, also known as the declining balance depreciation method, you claim depreciation at a higher depreciation rate in the first few years of ownership of the property. As a result, the depreciation deduction value will decrease each year until the asset value runs out. You can also increase the claim on items valued below $1,000 using low-value pooling.

The calculator uses both the diminishing value and prime cost method to give you an estimate of what you can claim on a depreciating asset, construction costs or capital allowance.

It’s important to understand that these are only estimates for your investment property’s capital works allowance and plant and equipment assets. So, the final claimable depreciation amount is subject to change.

The term “plant and equipment” refers to the fixtures and fittings that are found within investment properties and are generally easily detachable from the property. The ATO recognises more than 6,000 different assets that investors can claim tax deductions on.

Here are some items that are considered plant and equipment fixtures:

| RESIDENTIAL | COMMERCIAL |

| Oven, stovetop and rangehood | Fire hydrant booster |

| Air-conditioning units | Billi hot water unit |

| Smoke alarms | Door closers for door struts |

| Downlights | Coffee machine |

| Electric garage door & remotes | Warehouse cranes & hoists |

Investors can use the depreciation calculator for both pre-purchase or post-purchase situations.

Many investors don’t realise that depreciation is a significant claimable deduction on tax until after they’ve purchased it.

However, as investors become savvier or more informed, they also use this as a way to estimate savings they can make before committing to buying a property.

Absolutely not. The Duo Tax depreciation calculator allows you to use the straight-line depreciation rate or the double declining balance method (diminishing value) to estimate your potential deductions for free.

But, please note that while our calculator provides estimates based on common methods, there are other methods like accelerated depreciation that might be more suitable for certain assets. It’s always recommended to consult with a quantity surveyor, accountant or tax advisor to ensure you’re maximising your deductions.

Unfortunately, no, you can’t claim these figures as depreciation deductions.

According to the Australian Tax Office (ATO), your property must be surveyed and evaluated by a qualified quantity surveyor. While we try to keep the tax depreciation calculator as robust and comprehensive as possible, it does not replace a qualified quantity surveyor.

The depreciation calculator should be used more as an indication as opposed to a final accurate figure.

However, we’ve strived to make this property tax depreciation calculator as accurate as possible according to the available data we have, based on the thousands of properties we’ve inspected.

We find that many investors use this for research purposes to find out the first-year and second-year depreciation deductions and then contact us directly to get a more accurate estimate if they believe there are ample opportunities for tax depreciation claims.

This can be provided to you by your relevant local council.

You can also try searching your property address on Google as some real estate websites might have it listed too.

Not all properties are purchased at the start or end of the financial year to make for an easy depreciation estimate. This means that your first-year estimates may be slightly different to a real tax depreciation schedule’s figures because you’ll only claim partial-year depreciation instead of for a full year.

Scrap value, otherwise known as residual value or salvage value, is calculated differently and would require our team to provide you with a free estimated amount of how much depreciation you could potentially claim before your renovation or knockdown of the property.

The salvage value, also known as residual or scrap value, is the estimated value of an asset at the end of its useful life. It represents the amount you expect to receive when selling or disposing of the asset after it’s fully depreciated.

When calculating depreciation, the salvage value is subtracted from the asset’s initial cost to determine the total amount that will be depreciated over the asset’s useful life. You must estimate the salvage value accurately, as it impacts the annual depreciation expense.

Yes, click below to order a tax depreciation schedule.