The ATO has issued a reminder in August 2022 to investment property owners and tax agents about what they can and can’t claim when purchasing a second-hand property.

The main points to remember are that you can’t claim a tax deduction for the depreciation of second-hand plant and equipment assets or assets contained in a property that had previous owners. You can, however, claim a tax deduction if your property was rented out prior to July 2017, is newly built or has been substantially renovated.

The ATO issued the reminder to ensure that property owners aren’t submitting incorrect deduction claims come tax time. So, it’s important to know exactly what you’re allowed to claim when submitting your depreciation claim. If you’re not sure whether an item is eligible for depreciation, you can check with the ATO or seek professional advice from a quantity surveyor.

But here is a basic breakdown of what you can expect to claim when it comes to depreciation.

Claiming Depreciation on Residential Investment Properties

When it comes to investing in property, there are a number of tax benefits that can be accessed in Australia. One of these is depreciation. This is essentially a way of claiming a deduction for the wear and tear that occurs on a property over time. It can be a valuable deduction for investors, as it can help to offset the costs associated with maintaining an investment property.

There are two types of depreciation deductions available for properties: capital works deductions (Division 43) and plant and equipment deductions (Division 40).

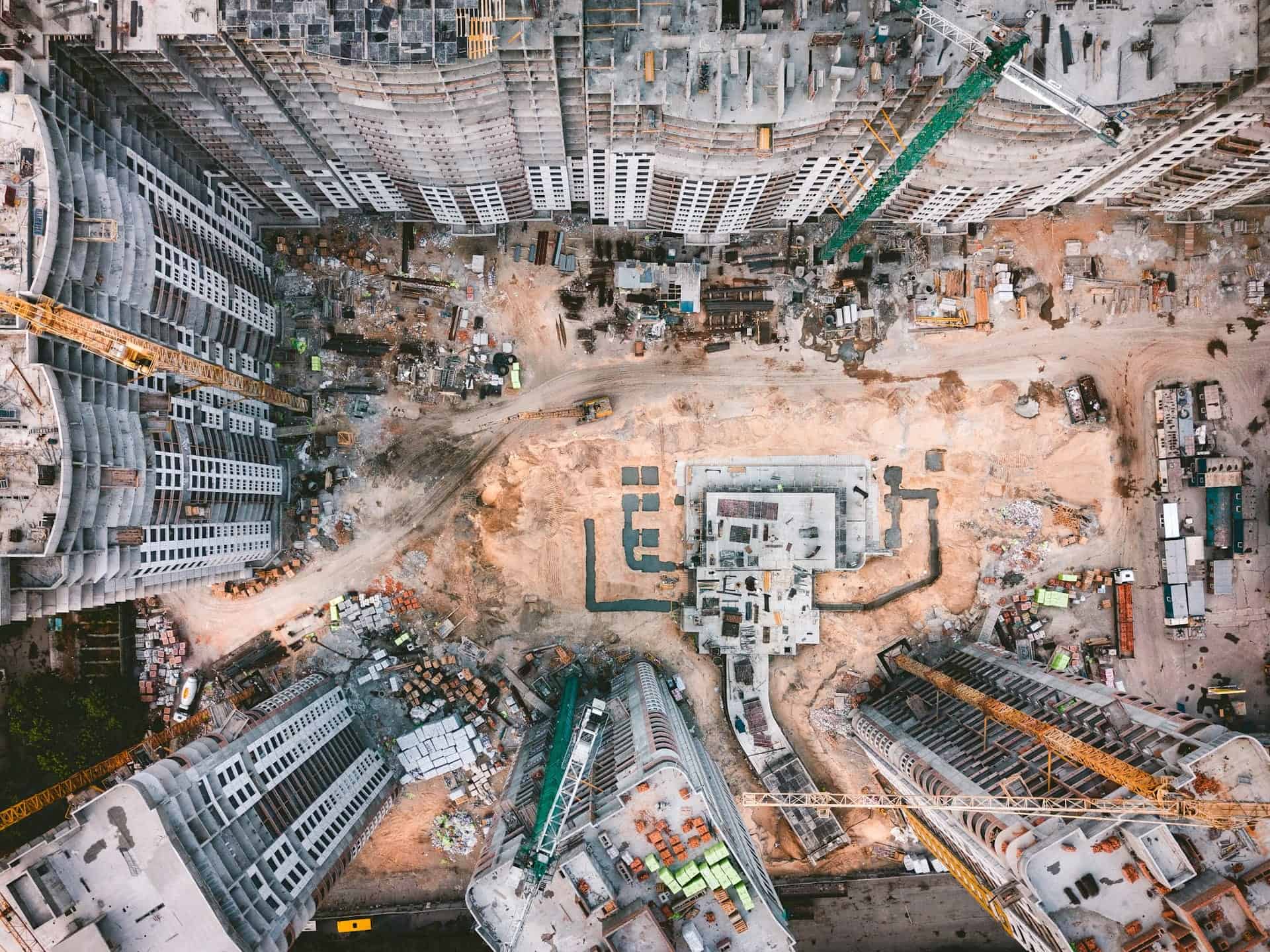

Capital works deductions are available for the building itself, as well as any items that are permanently fixed to the building, such as concrete slabs, retaining walls, and built-in wardrobes. Generally, residential properties built after 16 September 1987 can claim their capital works deduction at a rate of 2.5% per year over 40 years.

Plant and equipment deductions, on the other hand, are available for removable items such as dishwashers, air conditioners, and ceiling fans. Property owners can claim depreciation for their plant and equipment assets according to their effective life and the prescribed ATO rate.

To claim depreciation, investors must first have their property professionally valued by a quantity surveyor. They will identify all of the depreciable assets within the property and provide a depreciation schedule that can be used each year to claim deductions.

Limits on Plant and Equipment Claims for Second Hand Properties

In 2017, the ATO announced changes to the rules for claiming depreciation on second-hand assets. The main change was that investors could only claim depreciation on new plant and equipment assets for their investment property.

In other words, if an investor acquired a second-hand residential property after 7.30 pm (AEST) on 9 May 2017, they were no longer eligible to claim deductions for the depreciation on the plant and equipment assets contained in the property.

Second-hand investors who purchased a second-hand property before the cut-off date were unaffected by the legislation changes and could continue to claim as usual. And if you installed new assets in a second-hand property, you would still be eligible to claim a deduction for the depreciation of those new assets.

Example

Jude purchased a five-year-old townhouse in July 2021 with the intention of renting it out to derive investment income. When she made the purchase, there were a few depreciating assets that the previous owner had installed, including vinyl flooring, blinds, and an air-conditioning unit in the TV room.

Upon purchasing the townhouse, Jude installed a few new depreciable plant and equipment assets, including:

- a new dishwasher;

- new carpets in the two bedrooms; and

- an old washing machine that she had brought over from her main residence.

After consulting with Duo Tax, a quantity surveyor informed Jude that she couldn’t claim a deduction for the depreciation of the:

- vinyl flooring;

- blinds;

- air-conditioning unit in the TV room; and

- the washing machine.

This is because the ATO classifies these items as second-hand depreciating assets for tax purposes.

She can, however, claim depreciation deductions for the new dishwasher and carpets that were installed after she acquired the townhouse.

The ATO’s Recent Reminder to Tax Agents

It seems as though tax agents and property investors have been submitting depreciation claims for second-hand plant and equipment assets because the ATO had to recently publish a reminder of the rules.

In the published release, they set out to reaffirm that tax agents can only submit a deduction claim for the depreciation of assets for properties that:

- were rented out before 9 May 2017;

- are newly built; and

- have been substantially renovated.

They also included a list of questions that tax professionals should consider asking their clients before submitting the claim on their behalf. These questions include asking:

- when the property was purchased

- whether it was a new build or not

- whether they lived in the property prior to renting it out or not

- when the property was rented out

- whether the asset in question was purchased with the property or new installed

- whether or not the property was being used to carry out a business.

Once you have the answers to these questions, you should be equipped enough to submit the correct plant and equipment depreciation claim.

Key Takeaways

It seems as though tax agents have been submitting claims for second-hand assets despite the ruling published in 2017 barring investors from claiming depreciation deductions for second-hand assets for their investment property.

The ATO recently published a reminder about the second-hand asset rule, which specifically states that investors are not able to claim depreciation for any plant and equipment items that were installed in a property prior to their acquiring it. This includes items such as carpets, ovens, dishwashers, air conditioners, and hot water systems.

If a property has been renovated, only the plant and equipment installed as part of the renovation can be depreciated. If an investor purchases a brand-new property, however, they can claim depreciation on all plant and equipment items included in the sale.

For more information on the second-hand asset rule and other depreciation deductions that investors can claim, order a depreciation schedule from Duo Tax today.

YOU MIGHT ALSO LIKE: Why an Investment Property Depreciation Schedule is Crucial For Every Property Investor.

Ready to get started?

Talk to one of our friendly property experts to get a free quote or more Information.