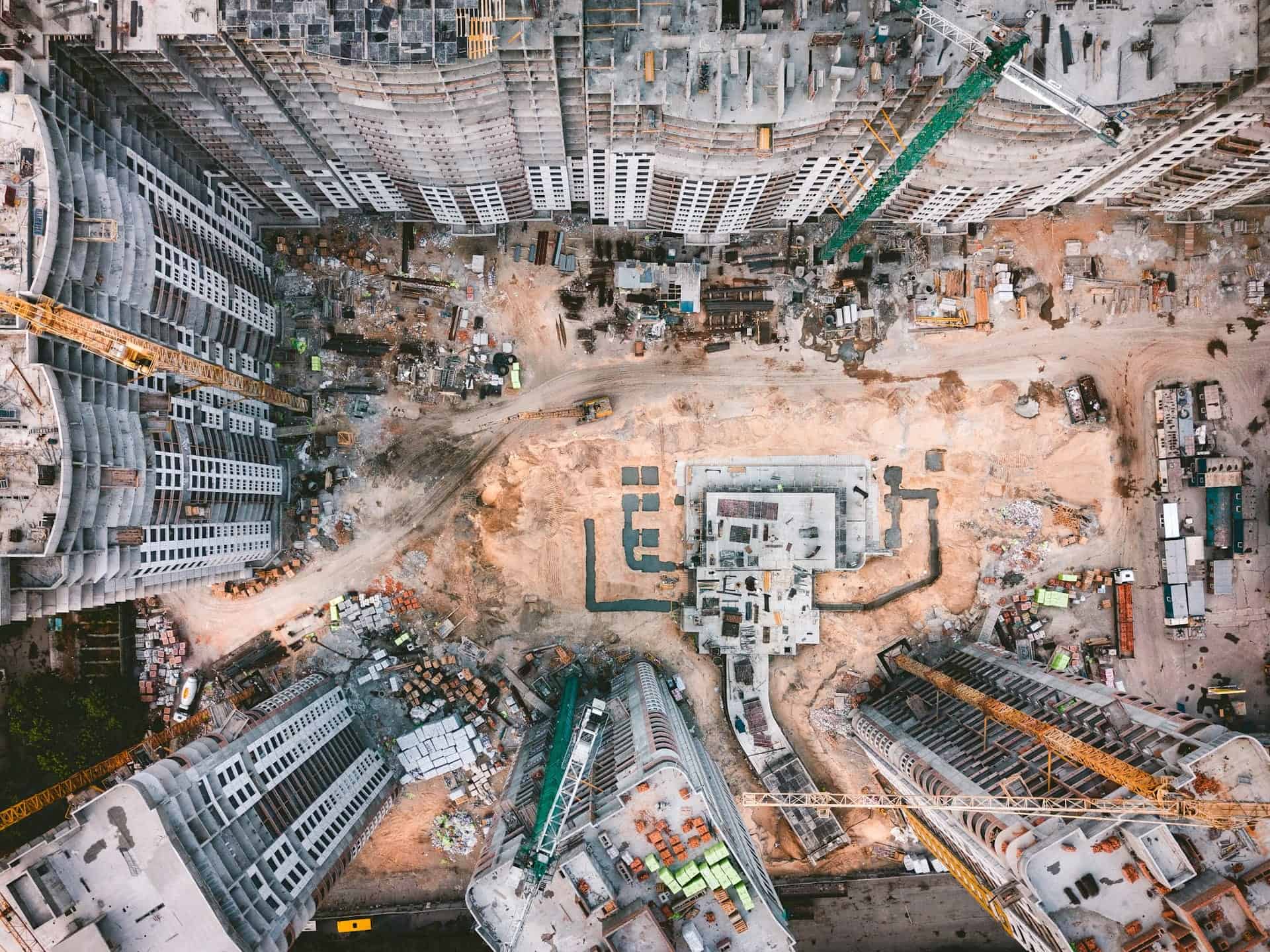

Have you thought about buying commercial property but been swayed by the perceived higher risk or the misconception that only wealthy investors can afford it?

While it may seem daunting to step into the commercial property market, it’s not out of reach – you just need to dig a little deeper into your research.

Arming yourself with as much knowledge as possible before buying a commercial property could save you thousands of dollars and help you eventually grasp positive returns.

For example, what are the differences in investing in commercial property versus residential property? What are the pros and cons of buying commercial property? What factors should you consider before buying commercial property? And what is commercial property depreciation?

To help guide your research, we’ve put together this complete guide to buying commercial property.

What Are the Differences in Investing in Commercial Property Versus Residential Property?

While investing in both types of property generally involves renting out the property to receive a rental income, how you approach buying commercial property versus residential property significantly varies.

For example, commercial lease agreements generally span over a more extended period in comparison to residential leases. Where residential leases tend not to run past one year, commercial leases generally extend over a couple of years, with annual rental amount reviews.

Of course, the main difference is that commercial properties are primarily used to carry out businesses, whereas residential properties are used as homes.

Other fundamental distinctions include:

- the tenant of the commercial property generally incurs the cost of maintenance and repairs expenses, so in most cases, commercial property owners generate a higher rental income which means that they are more likely to deliver a positive cash flow;

- commercial property tenants are also responsible for paying expenses such as rates and taxes as well as insurance whereas residential property tenants aren’t

- due to the longer duration of commercial property lease agreements, it’s more challenging to replace a commercial tenant than a residential one; and

- vacancies between different commercial property tenants tend to be longer. The demand for commercial real estate is significantly more elastic – which means that the demand for commercial property frequently fluctuates compared to the residential property because people always need home

Based on the significant differences, buying commercial property requires investors to have a broader understanding of the economy, so it is generally advised that you conduct extensive research before investing in commercial properties.

What Are the Pros of Buying Commercial Property?

Given the exposure to economic shocks (because of a fluctuating market), you may be wondering what the benefits are of commercial property investment.

While many investors may perceive buying commercial property a higher risk because of this fact, that isn’t the only factor to take into account.

There are many benefits too!

For example, the primary benefit of commercial property investment is that it promises higher returns due to:

- higher yields: commercial real estate favours a rental yield anywhere between 5% and 12%, whilst rental property typically catches sight of around 3% – 4%;

- higher yields equal more potential for positive cash flow;

- rental income stability because leases are longer;

- annual rent increases: the majority of commercial property lease agreements contain a fixed rental increase clause, and generally the increases are higher than inflation, ranging between 3% and 4%; and

- tax benefits: you can save thousands of dollars in depreciation tax deductions

What Is Commercial Property Depreciation?

As a building gets older, its structure and the assets within the building are subject to general wear and tear. In other words, each year, the value decreases and thus, depreciates.

The Australian Tax Office (ATO) allows commercial property investors and its tenants to claim depreciation as a tax deduction if the property is used to produce income.

There are two types of commercial property depreciation deductions:

- Division 43 – Capital Works Deductions

- Division 43 capital works deductions refer to the depreciation of the structure of the building. Generally, commercial property owners can claim depreciation on a commercial building if it was constructed after 20 July 1982

- Division 40 – Plant and Equipment

- The term “plant and equipment” (or Division 40) refers to the fixtures and fittings found within the building. These are generally known as easily removable assets and span across light fittings and carpets to commercial pieces of machinery such as conveyor belts. Plant and Equipment assets are depreciated according to their value and effective life as determined by the ATO

Taking advantage of these commercial property tax depreciation deductions can result in a substantial cash flow benefit and optimised liquidity.

You can do this by ordering a depreciation schedule.

Simply put, a commercial property depreciation schedule is a report that details the tax depreciation deductions you can claim on your investment property. Make sure to check out our guide to why a depreciation schedule is essential for all property investors.

Example:

Sean purchased a commercial property in January 2019. The property is best suited as a retail space.

After having a Duo Tax Quantity Surveyor draw up a depreciation schedule, it was determined that the retail property was built in 2006. It had carpeted flooring as well as guest bathrooms equipped with blinds and bathroom accessories.

After purchasing the property, Sean decided to fit-out the property with new timber flooring and one air conditioning unit in the retail space. The total cost amounted to $18,980.

As the landlord of the retail space, Sean can claim a commercial property tax depreciation deduction for the following items:

- capital works of the building;

- the new timber flooring;

- the air conditioning unit; and

- other existing plant and equipment assets

What Are the Risks of Buying Commercial Property?

Although there are plenty of benefits to buying commercial property, you also need to be aware of the price you may have to pay for those higher returns.

As mentioned in the distinctions between investing in commercial property versus residential property, the most significant risk of buying commercial property is the fluctuating market. Commercial properties aren’t in as high of a demand, so you risk higher vacancy periods.

Factors that affect the demand for commercial properties include:

- demographics;

- interest rates; and

- population growth

For that same reason, commercial properties are harder to sell, resulting in a lack of liquidity.

Other downfalls of buying commercial property, you should consider:

- stricter mortgage terms: given the perceived risk associated with buying commercial property, banks often ask for a high deposit (at least 30%) and charge higher administrative fees and interest rates;

- GST implications: buying commercial property triggers Goods and Services Tax (GST), which could cost you up to 10% of the purchase price

- complex leases, so you’ll have to engage with and rely more heavily on solicitors or conveyancers; and

- potentially higher renovation costs: given that the property is generally bigger, you’ll have to fork out more on renovations if you wanted to upgrade your commercial property

What Other Factors Should You Consider Before Buying Commercial Property?

Other than weighing up the pros and cons of buying an investment property, there a few other factors you should consider, such as:

- Does the commercial property have an existing tenant?

- If you’re a first-time commercial property investor, you may want to consider buying a property with an existing long-term tenant to avoid extended vacancy periods. This is an ideal situation because you’ll already have a reliable tenant in place, fewer initial expenses and the lease agreement will cover the annual rent increases.

- Does the commercial property tick the right location boxes?

- With any property investment, location is a significant factor to consider when your property is vacant, and you need to find a tenant. You need to think about the location in relation to a suitable tenant. For example, if you’re thinking of buying a factory, you may want to consider an industrial area with a demand for manufacturing space. You’ll also want to consider the infrastructure. Is it close to major roads, airports or shipping ports? Are there transport hub facilities in the area?

- What is the quality of the commercial property itself?

- Depending on the business you want to attract, you’ll have to make sure that you’re buying a commercial property attractive to those particular types of tenants. You’ll also want to make sure that the building’s actual structure is in good shape because you might want to hold off on any significant renovations until you have a tenant and a cashflow.

- Don’t do it on your own!

- There are a range of property professionals that can help you when buying commercial property, such as:

- accountants;

- mortgage brokers;

- conveyancers; and

- quantity surveyors

- There are a range of property professionals that can help you when buying commercial property, such as:

This is especially crucial because you’ll need a good understanding of the property market and the economy. You can access our top steps to buying an investment property to learn more about the property professionals you should consult with.

Key Takeaways

The most crucial advice we can give you if you are considering buying commercial property is: do as much research as possible on all aspects of the economy, the market and how it relates back to your potential commercial real estate purchase.

Beyond that, remember to weigh up the pros and cons, speak to an expert and remember those all-important tax deductions – especially depreciation!

Given we’re tax depreciation experts, did you know that 70% of property investors in Australia don’t buy a tax depreciation schedule?

Depreciation schedules are among the most effective but underused tools available for property investors to maximise their returns.

As a team of property investors ourselves, we, at Duo Tax, understand that every dollar counts. We’ve got the expertise to help you maximise the return on your investment.

Are you considering buying a commercial property and need some depreciation advice? Or are you the owner or the tenant of commercial investment property and currently not claiming commercial property depreciation?

If so, fill out this form to get a free estimate from a Duo Tax specialist quantity surveyor on how much you can save each year.

Ready to get started?

Talk to one of our friendly property experts to get a free quote or more Information.