The plant and equipment depreciation rate that’s set by the ATO can be complex to navigate. But this powerful tool can be a weapon for savvy investors, yet it’s one that’s often overlooked. Tax deductions like this can make a substantial difference to an investor’s bottom line, but many fail to take full advantage of them.

The reason?

It often boils down to a lack of understanding about what depreciation is, how it works, and, most importantly, how to claim it.

So, we’re going to clear up the confusion around one specific type of depreciation: plant and equipment depreciation.

Why Do I Need to Understand Property Depreciation?

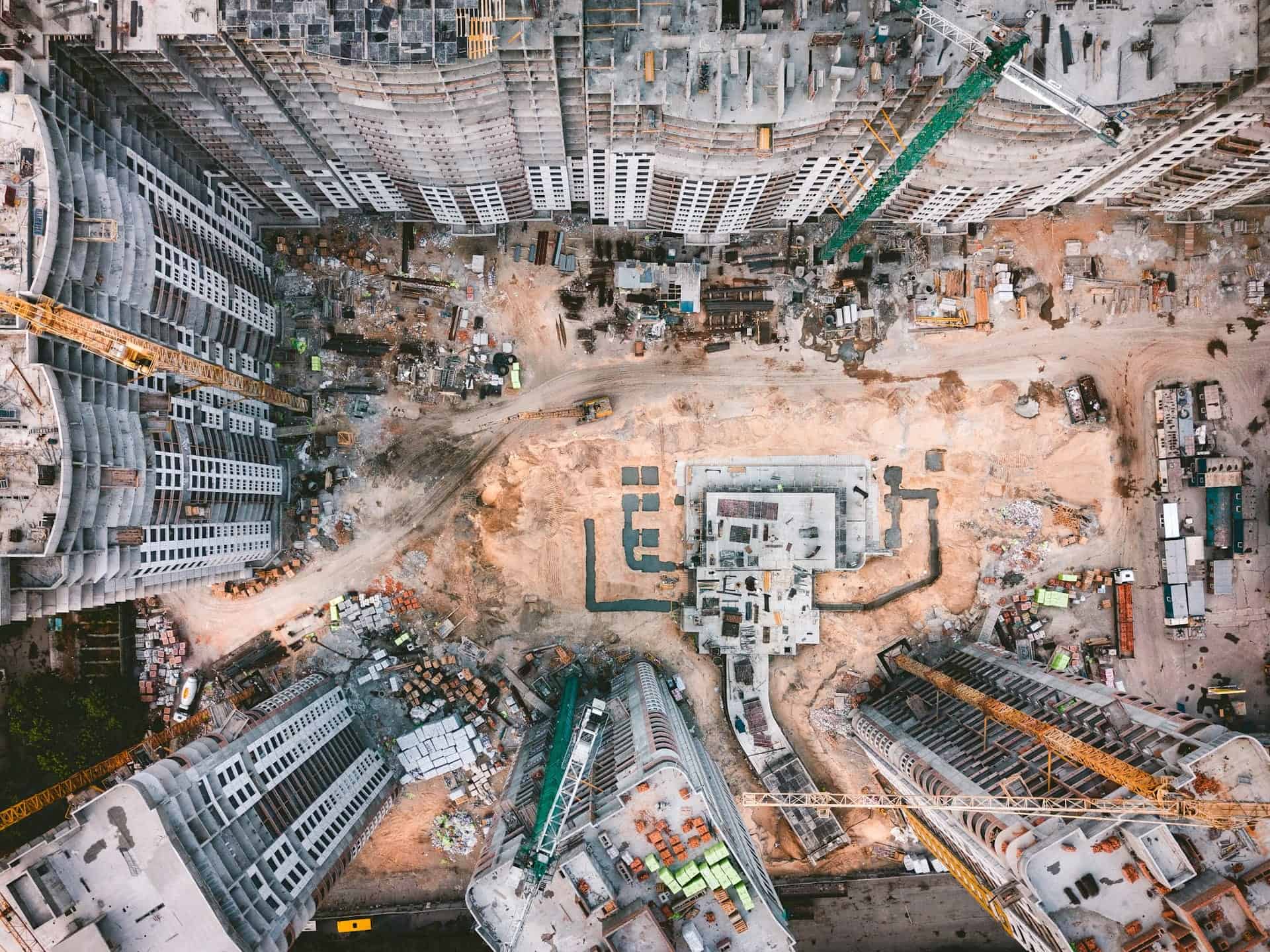

Property depreciation is the gradual reduction in the value of a property’s building structure and assets over time due to factors like wear and tear, aging, or becoming outdated.

In Australia, investors can claim depreciation as a tax deduction, offering a significant benefit by lowering their taxable income, which is why it’s such an important concept to grasp.

Knowing how to claim property tax depreciation can lead to substantial savings, making it a valuable strategy for optimising your investment returns.

The Australian Taxation Office (ATO) splits property depreciation into two distinct categories:

- Division 43 and

- Division 40.

Division 43: Capital Works Allowance

Division 43, known as the Capital Works Allowance, pertains to the property’s building structure and any permanent fixtures. This includes elements like the building’s walls, roof, windows, doors, and built-in kitchen or bathroom units.

These items typically depreciate at a rate of 2.5% per year over 40 years, starting from when the construction was completed. It’s worth noting that this applies only to properties constructed after July 1985.

Division 40: Plant and Equipment

Division 40, on the other hand, refers to Plant and Equipment. This category includes removable or mechanical assets within the property, such as appliances (e.g., dishwashers and ovens), carpets, blinds, air conditioning systems, and furniture in a furnished property.

The ATO sets varying depreciation rates for these items based on the asset’s effective life.

Plant and Equipment Effective Life and Depreciation Rates

The effective life of an asset is an estimate of the time (in years) that a depreciable asset can be used for income-producing purposes. The ATO provides guidelines on the effective life of various assets, which can be used to calculate their depreciation rates.

The depreciation rate for plant and equipment assets is determined based on their effective life. The ATO uses two methods to calculate depreciation:

- the prime cost method;

- and the diminishing value method.

Prime Cost Method

The prime cost method assumes that the value of a depreciating asset decreases uniformly over its effective life. It’s a straightforward approach where the immediate deduction for each year is calculated as a percentage of the cost.

Diminishing Value Method

On the other hand, the diminishing value method assumes that the value of a depreciating asset decreases more in the early years of its effective life. Therefore, the deductions are higher in the earlier years and decrease over time.

The choice between these two methods depends on your strategy and cash flow needs.

How to Determine the Effective Life of an Asset

The Commissioner of Taxation provides a guide that lists the effective life of many assets commonly found in rental properties. This guide is updated annually and is based on the Commissioner’s estimates of how long such assets will last before they need to be replaced.

For example, according to the Commissioner’s guide, a dishwasher might have an effective life of 10 years, while a carpet might be expected to last 8 years. This means that, under the prime cost method of depreciation, a dishwasher worth $1000 would depreciate at a rate of $100 per year over its effective life.

However, it’s important to note that the effective life of an asset can vary depending on a range of factors. These include the quality of the asset, how often it’s used, and the conditions under which it’s used.

The Commissioner’s Role in Plant and Depreciation Equipment Rates

The Commissioner’s estimates are based on a wide range of information, including industry advice, testing reports, and other relevant factors.

These estimates are designed to reflect the average time period over which a particular type of asset is likely to be used for income-producing purposes. They provide a useful starting point for property investors when calculating their depreciation deductions.

Determining Your Own Effective Life Estimates

While the Commissioner’s estimates are a useful guide, they may not always fit your specific circumstances. For example, if you have a high-quality carpet that is well maintained and used lightly, it may well last longer than the 8 years estimated by the Commissioner.

In these cases, the ATO allows you to make your own estimate of the effective life of an asset. This can be based on your own experience, the manufacturer’s specifications, and any other relevant factors.

However, if you choose to estimate the effective life yourself, you need to be able to justify your estimate. You should keep records of how you worked out the effective life in case the ATO asks for more information.

Claiming Depreciation on Plant and Equipment

To claim depreciation on plant and equipment in your residential investment property, you’ll need a tax depreciation schedule, which is a comprehensive report that outlines all the depreciating assets within your property and how much they depreciate each year.

A qualified quantity surveyor, who is recognised by the ATO as appropriately qualified to estimate the value of assets for the purposes of depreciation, can prepare this schedule.

Key Takeaways

- Depreciation is a tax deduction that can significantly enhance the returns on your property investment. It’s the gradual reduction in the value of a property’s building structure and its assets over time.

- The ATO splits property depreciation into two categories: Division 43 (Capital Works Allowance) and Division 40 (Plant and Equipment).

- The effective life of an asset is an estimate of the time that a depreciable asset can be used for income-producing purposes. The ATO provides guidelines on the effective life of various assets.

- The Commissioner of Taxation provides a guide that lists the effective life of many assets. However, if the Commissioner’s estimates do not fit your specific circumstances, the ATO allows you to make your own estimate.

- To claim depreciation on plant and equipment, you’ll need a tax depreciation schedule. A qualified Quantity Surveyor can prepare this schedule.

Our team of qualified Quantity Surveyors at Duo Tax can provide a comprehensive tax depreciation schedule, helping you claim the maximum allowable deductions.

Contact us today to learn more about how we can help you optimise your investment returns.

Ready to get started?

Talk to one of our friendly property experts to get a free quote or more Information.