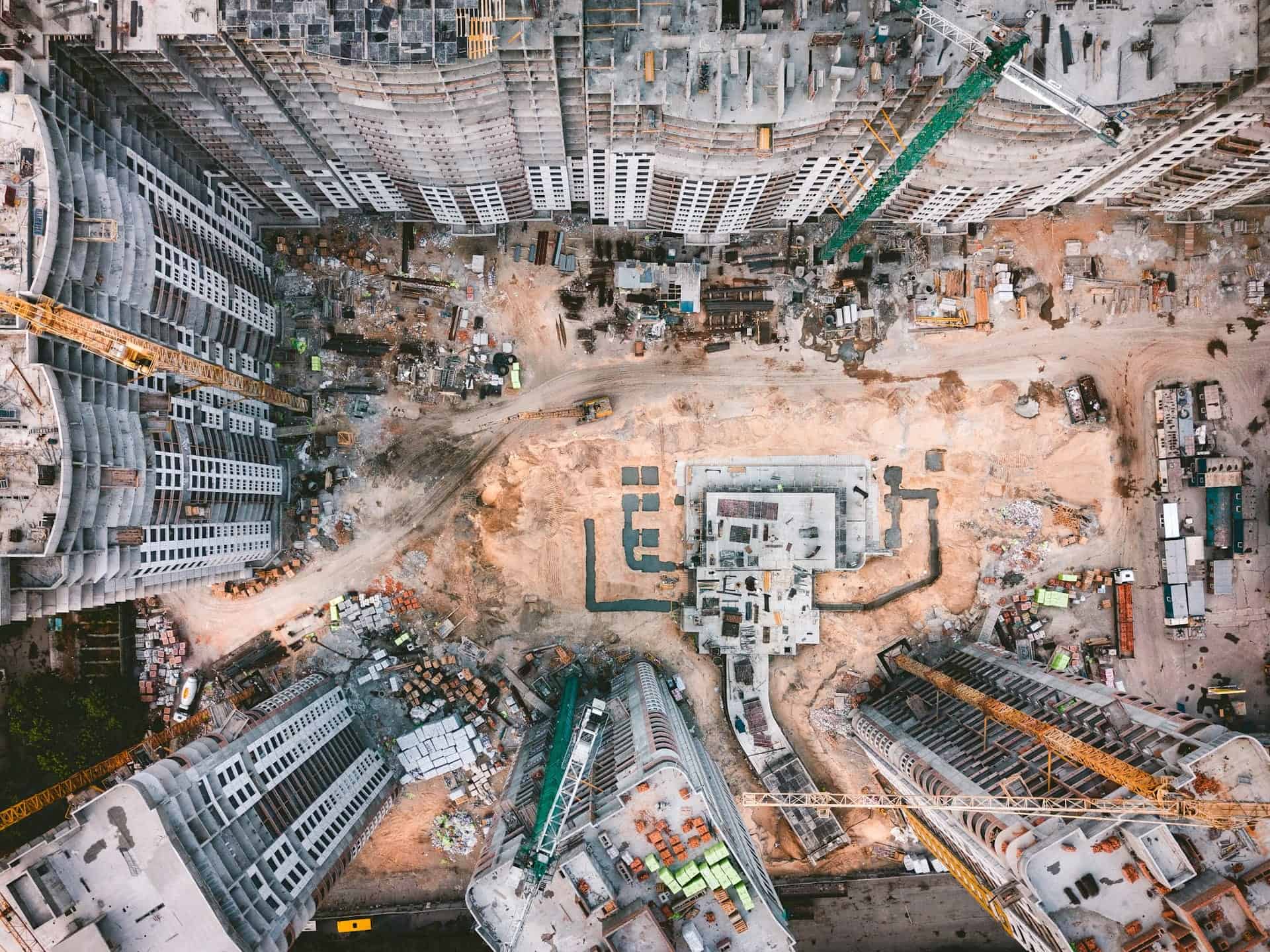

A duplex house is among the most common dual-income investments in Australia.

This is mostly because duplex houses have become one of the most popular ways to deal with housing affordability across the major cities.

They take up the same amount of land as a single home, but they are subdivided to support two homes.

For property investors, a duplex house could be a way to improve their equity over a short period and ultimately fast-track their way up the property ladder.

What’s more is that generating a rental income from a duplex house offers substantial tax deductions for property investors, including depreciation.

As with all investment strategies, however, it’s vital to consider all your options and determine how they would align with your current financial situation and future financial goals.

So, we’ve created this guide to give you an overview of the duplex house investment strategy and how you can save on claim tax depreciation deductions.

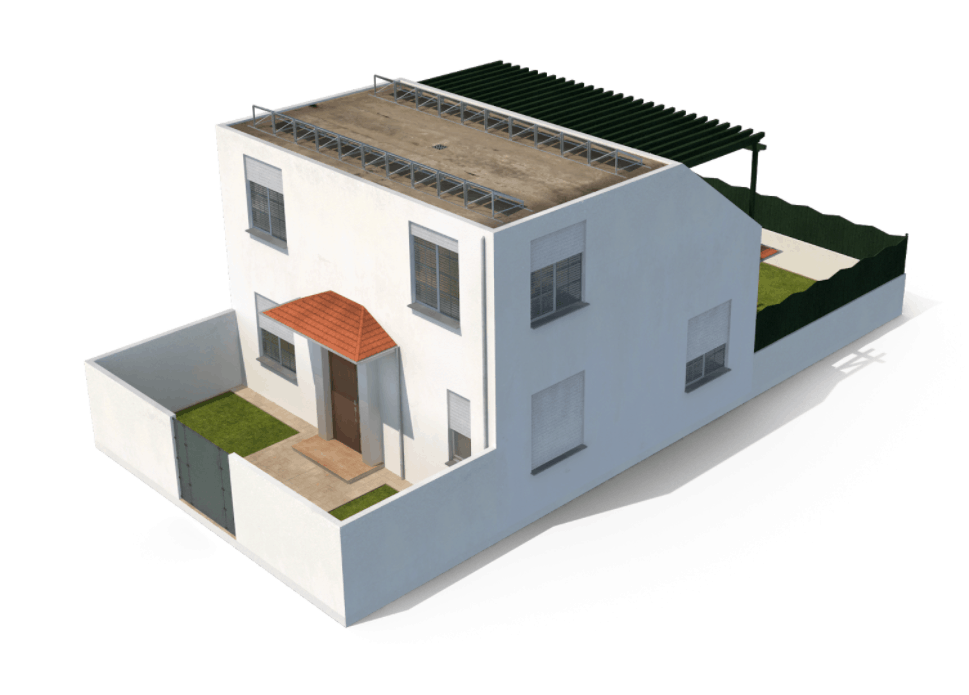

What Is a Duplex House?

A duplex house is a single property on one block of land divided into two separate residences. The two individual homes are under one roof, but generally, there are different occupants living in each unit.

So, each residence has its own:

- front door;

- kitchen;

- amenities; and

- any other features you would expect from a single freestanding home.

What’s more, they aren’t always split equally and come in all shapes and sizes. For example, one residence could be a three-bedroom home, while the neighbouring residence could be a two-bedroom home.

What Are the Pros and Cons of Investing in a Duplex House?

Before opting to settle on a property investment strategy, you must consider all factors, including the pros and the potential risks.

Potential Benefits of Investing in a Duplex House

- Double the rental income: this is arguably the most significant reason why property investors gravitate towards duplex houses. Since a duplex house is essentially a two-for-one property, you could potentially double your rental income if both units are occupied.

- Flexibility: a duplex house is generally not more expensive than a single-family home, so you could purchase the property, occupy one residence and rent out the other to help you make the mortgage repayments.

- No need to subdivide: unlike subdivided land, a duplex house doesn’t attract additional holding fees, insurance premiums, stamp duty and council rates. Both residences will be on one title, so your council fees are reduced unless you decide to re-title.

- Depreciation deductions: the advantage of having two properties is that you receive the benefit of higher tax depreciation on your investment – especially if you rent out both units.

Potential Risks Associated With Investing in a Duplex House

- Higher maintenance costs: maintenance costs and other associated expenses can end up costing more since, essentially, you own two separate homes.

- Living with your tenants: if you live in one unit and become the landlord of another, you’ll be living next door to your tenants. This could end up causing a few headaches, especially if they consistently knock on your door.

Duplex House Tax Depreciation

The Australian Tax Office (ATO) allows all property investors to claim their rental property expenses, including depreciation, as a tax deduction, provided that they continue to generate rental income from that property.

It’s no different for duplex houses. The owners of duplex houses receive the benefit of higher tax depreciation because you can claim on both properties if they’re both rented out. Not only is a duplex construction typically bigger and can use more of the land to build on, but mainly because there is double the amount of plant and equipment that can be claimed as two self-contained units.

While you can claim a list of various tax deductions, tax depreciation is one of the most significant tax-deductible expenses you can claim.

What Is Depreciation?

Depreciation is a non-cash tax deduction that property investors can claim over the lifespan of your property’s structure and the plant and equipment assets within the property.

Each year the plant and equipment assets, as well as the structure of your property, depreciates. This means that it’s subject to general wear and tear each year.

There are two types of depreciation deductions that the ATO allows property investors to claim on their duplex houses:

Division 43 – capital works deductions:

Capital works deductions, also referred to as Division 43 deductions, apply to the depreciation (i.e. the general wear and tear) of the building’s structural components and any items fixed to the property, including:

- flooring and carpets;

- fences;

- retaining walls;

- bricks and mortar; and

- bathroom fittings such as baths, showers and toilet bowls.

The structure of a residential building, if constructed after September 1987, generally has an effective life of 40 years.

This means you can claim a 2.5% depreciation deduction on your investment property for 40 years from the date of construction.

For a comprehensive list of claimable Division 43 assets, make sure you check out our essential guide to capital works deductions.

Division 40 – plant and equipment:

The term “plant and equipment” or Division 40 assets refers to the fixtures and fittings found within the building are generally known as easily removable assets and include items such as:

- kitchen assets such as dishwashers and ovens;

- air conditioning units or ceiling fans;

- window blinds and curtains; and

- hot water systems.

Plant and equipment assets depreciate over their effective life.

According to the ATO, the effective life of a depreciating asset is how long it can be used to produce an income.

For example, a dishwasher has an effective life of five years.

A duplex house usually draws high amounts of depreciation because you’re claiming on more than one property.

For example, you could claim depreciation for each dishwasher in each duplex residence.

Note, however, if you’re only renting out one of the duplex units and occupying the other unit, you’d only be able to claim depreciation on the structural components and plant and equipment assets of the duplex unit that you’re generating a rental income from.

Depreciation Schedule for Your Duplex House

To claim depreciation deductions on your duplex house, you’ll have to identify the value of the property and all its plant and equipment assets.

To have your property evaluated, you’ll have to consult with a quantity surveyor.

Once the structural components and assets have been valued, the quantity surveyor will draw up a depreciation schedule.

The purpose of a depreciation schedule is to outline the value of both your Division 40 and Division 43 assets, as well as how much it has depreciated and will depreciate.

This will give you a clear idea of how much depreciation you can claim on your duplex house.

Key Takeaways

There’s no doubt that investing in a duplex house could be a great way to climb the property ladder.

There’s a possibility of generating double the rental income and higher depreciation deductions. While there are many benefits associated with investing in a duplex house, make sure to consider all your risks too!

Another factor to consider would be that each state and territory has its own council approval rules and size restrictions, so make sure to check those out.

Remember to take advantage of all the tax deductions available to you, especially depreciation. Claiming these deductions can help significantly improve your cash flow.

The Duo Tax team has helped many property investors maximise their deductions on their duplex houses through the power of investment property depreciation schedules.

We offer free immediate and accurate over-the-phone estimates so that you can decide if ordering an investment property depreciation schedule is worth your while.

You can obtain your depreciation schedule from Duo Tax in 3 simple steps:

- Get in touch with us, and we will ask you a few simple questions to see if your property qualifies.

- Order a depreciation schedule over the phone or via our online form, and we will begin preparing your depreciation.

- Within 5-10 business days, we will deliver your personalised depreciation report to you and your accountant.

.

Ready to get started?

Talk to one of our friendly property experts to get a free quote or more Information.