With property prices rising, it’s easy to understand why investing in granny flats has become a popular investment strategy.

In 2018, around 6000 granny flats were built in New South Wales alone.

The increase in popularity of granny flats can also be credited to state-level legislative changes to improve housing affordability in capital city areas.

But does the boost in interest make investing in granny flats a good strategy?

Well, granny flats offer the opportunity to start investing without having to break the bank, and it could add value to an existing property – be it your primary place of residence or one of your current investment properties.

What’s more is that generating a rental income from granny flats offers substantial tax deductions for property investors, including depreciation.

It is, however, necessary to consider all your options.

If you’re thinking about investing in a granny flat, we’ve put together this ultimate guide to help you weigh up the pros and cons and how to go about claiming those all-important tax depreciation deductions.

What Are Granny Flats?

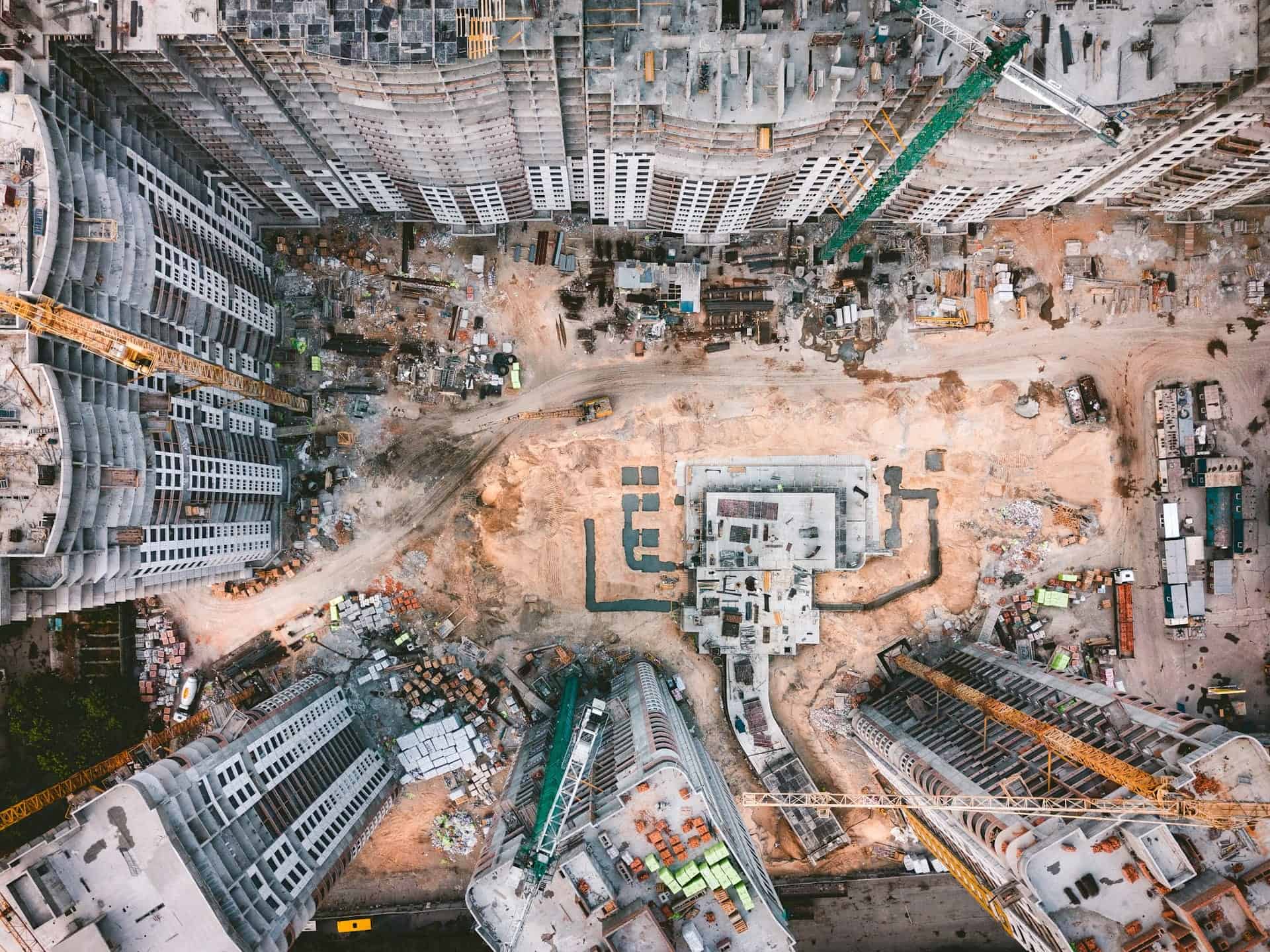

Granny flats are secondary properties usually built on the premises of an existing property.

So, think of it as an extension of your property, but with its purpose being to generate a rental income in the same way you would with an apartment or flat.

Essentially, the only difference between a granny flat and an apartment is that it’s not bought separately and exists on your own land.

What Are the Pros and Cons of the Granny Flat Investment Strategy?

As with all property investment strategies, it’s essential to consider all the necessary factors, including the benefits and the potential risks.

What Are the Potential Benefits of Investing in Granny Flats?

- Generating extra income: building a granny flat at the back of a property you already own, be it your primary place of residence or an investment property, can be an additional source of rental income.

- Diversified risk: if you’re adding a granny flat to an existing investment property, you’ll potentially be getting two sources of income, or at least one, if the other property is vacant.

- Depreciation deductions: adding a granny flat to your existing property increases the number of depreciation deductions you can claim with your depreciation schedule.

- Good family investment: Granny flats are a good family investment because you may use them to generate a rental income now, but when it comes time to have your children move out, this could be a good stepping stone for them. You could also use the granny flat to create more privacy within a family if you require extra space for a parent or elderly relative that needs to be cared for.

What Are the Risks of Investing in Granny Flats?

- A reduced pool of possible tenants: if they’re not looking for an apartment, tenants generally prefer standalone homes, so the pool of tenants is usually restricted to granny flats.

And If your granny flat is built next to an existing investment property, that tenant pool is also likely to be reduced. - Small resale demand: one of the most substantial risks of granny flats is that they are generally more attractive to property investors and not owner-occupiers.

Most owner-occupiers are not keen to have a granny flat in their backyard. Keep in mind that the owner-occupier rate in Australia is around 70%. So, if owner-occupiers aren’t necessarily looking to buy properties with granny flats, the potential resale market is significantly reduced. - Overcapitalising: Granny flats don’t always add substantial value to the existing property. In most cases, you’ll find that banks will increase the value of your property by less than the construction costs.

For example, according to Michael Yardney at PropertyUpdate, if Joan spends $120,000 on building a granny flat, the bank will probably increase her property value by around $80,000.

Claiming Tax Deductions on Granny Flats

The Australian Tax Office (ATO) allows all property investors to claim their rental property expenses as a tax deduction, as long as they continue to generate an income from that property.

It’s no different for granny flats.

Taking advantage of these tax breaks could be the difference between positively gearing or negatively gearing your property, so it’s worthwhile being equipped with tax deduction knowledge.

We’ve put together a list of tax deductions that property investors can claim, so make sure you check it out.

One of the most significant tax deductions on that list is depreciation.

What Is Depreciation?

Depreciation is a non-cash tax deduction that property investors can claim over the lifespan of your property’s structure and the assets within the property.

Each year the assets and structure of your investment building are subject to general wear and tear. This is called depreciation.

The ATO allows you to claim two types of depreciation deductions:

A. Division 43 – Capital Works Deductions:

Capital works deductions, or Division 43 deductions, apply to the depreciation of the building’s structure.

The structure of a residential building, if constructed after September 1987, generally has an effective life of 40 years.

This means you can claim a 2.5% depreciation deduction on your investment property for 40 years from the date of construction.

Assets that you can claim under capital works deductions include:

- bricks and mortar;

- flooring;

- fences;

- retaining walls; and

- bathroom fittings such as baths, showers and toilet bowls.

For a comprehensive list of claimable Division 43 assets, make sure you check out our essential guide to capital works deductions.

B. Division 40 – plant and equipment:

The term “plant and equipment” refers to the fixtures and fittings found within the building are generally known as easily removable assets.

Plant and equipment assets found in the property will generally wear out more rapidly than the building’s actual structure, so these depreciating assets’ effective life is shorter.

For example, a carpet, which is subject to a fair amount of wear and tear, has an effective life of eight years.

Plant and equipment assets that you could potentially claim on granny flats include:

- kitchen assets such as ovens and cooktops;

- hot water systems;

- window blinds;

- curtains; and

- air conditioning units or ceiling fans.

Granny flats often attract high amounts of depreciation because you can also claim depreciation on the areas that the granny flat shares with your home. For example, you could claim on a pool or a patio if the tenant has access to those assets.

Note, however, if you’re renting out the granny flat and occupying the other property, you’d have to apportion the depreciation deductions for the shared spaces based on what your rental expenses are.

If both properties (i.e. the granny flat and the existing property) are used to generate an income, you can claim at least two bathrooms, two kitchens, and sometimes even two laundries.

If, after weighing up the potential benefits and risks of investing in granny flats, you’ll want to make sure you get your hands on a depreciation schedule to claim these depreciation deductions.

The purpose of a depreciation schedule is to outline the value of both your Division 40 and Division 43 assets, as well as how much it has depreciated and will depreciate.

This will give you a clear idea of how much you can claim.

Key Takeaways

There is no doubt that investing in granny flats is on the rise.

The increasing number of granny flats built each year can be attributed to the fact they are relatively cheap to build, and council approval is generally easier to obtain. There are plenty of depreciation deductions available to investors to take advantage of.

While there are benefits associated with granny flat investments, make sure to consider all your risks too!

Another factor to consider would be that each state and territory has its own council approval rules and size restrictions, so make sure to check those out.

And remember: depreciation deductions can significantly reduce your taxable income and help you realise a positive cash flow on your granny flat investment sooner.

You can obtain your depreciation schedule from Duo Tax in 3 simple steps:

- Get in touch with us, and we will ask you a few simple questions to see if your property qualifies.

- Order a depreciation schedule over the phone or via our online form, and we will begin preparing your depreciation.

- Within 5-10 business days, we will deliver your personalised depreciation report to you and your accountant.

Ready to get started?

Talk to one of our friendly property experts to get a free quote or more Information.