Not sure if stamp duty is tax-deductible?

You’re not alone.

Many first-time investors find themselves asking: is stamp duty tax-deductible? It’s not surprising because stamp duty is the one acquisition expense that is likely to poke a significant, perhaps unexpected, hole in your budget.

This article will equip you with all you need to know about stamp duty on investment property, including whether or not stamp duty is tax-deductible.

What is Stamp Duty on Investment Property?

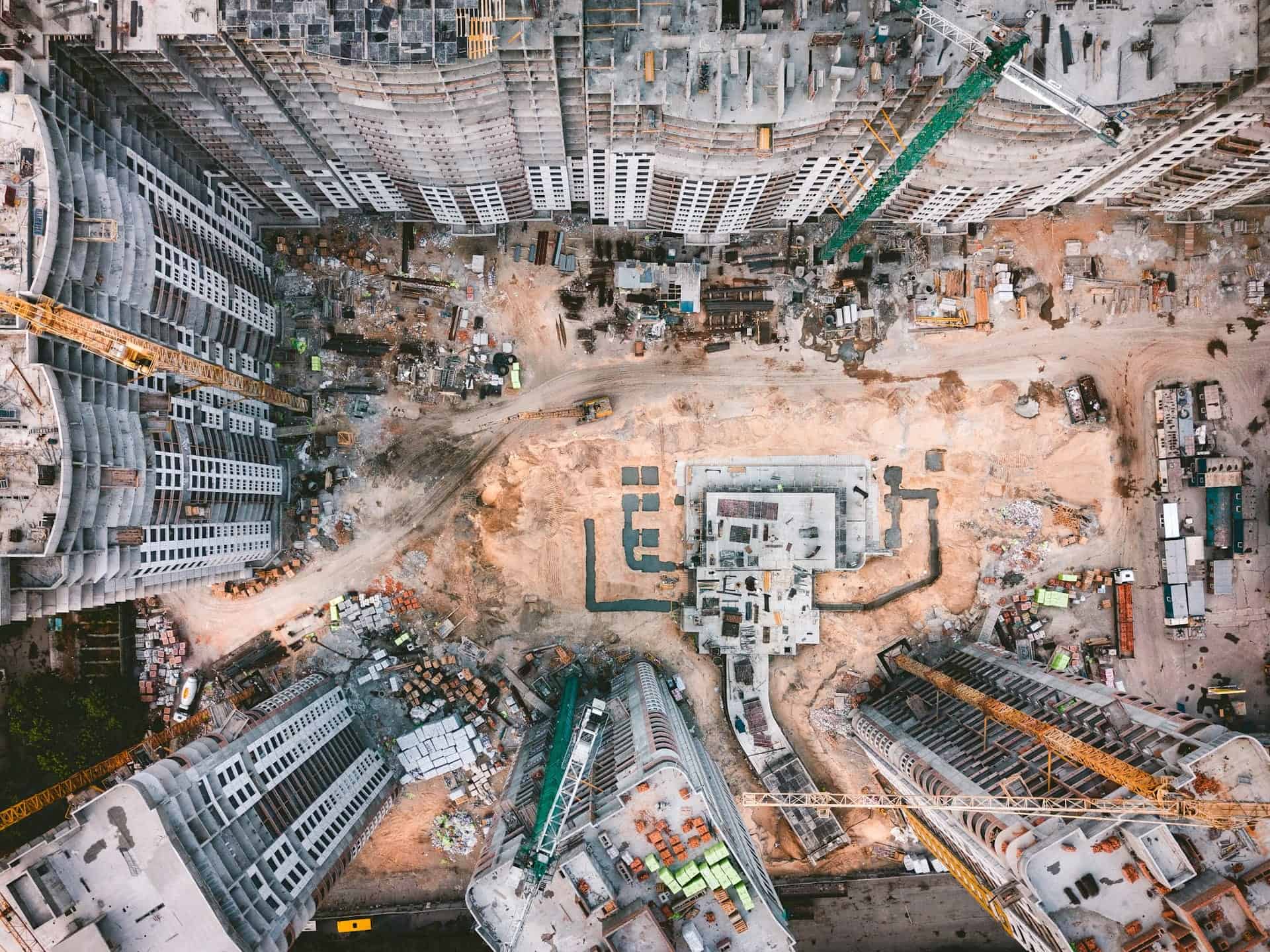

So many first-time property investors are hit with a nasty surprise once they realise that many additional purchasing expenses come with buying an investment property.

One of these purchasing expenses includes stamp duty costs.

Stamp duty is a form of tax that is levied by the government for the transfer of the property from the seller to the buyer. The transfer duty is payable by the investment property buyer and is generally due within 30 days after settlement of the property.

However, the payment due date is dependent on which state or territory the property is purchased. For example, in New South Wales (NSW), stamp duty must be paid within three months of settling the property, while in Queensland (QLD), you need to pay the stamp duty within 30 days.

Stamp duty rates are similarly dependent on various factors, such as:

- which state or territory you live in;

- the property’s value or purchase price;

- whether you are a first-time buyer or not; and

- if the home will be your primary place of residence (PPOR) or an investment.

Stamp duty fees are fully outlined in each state or territory’s revenue office:

Example 1:

The table below is an example of stamp duty calculations from 1 July 2020 in NSW:

| Property Value | Transfer Duty Rate |

|---|---|

| $0 to $14,000 | $1.25 for every $100 (the minimum is $10) |

| $14,000 to $31,000 | $175 plus $1.50 for every $100 over $14,000 |

| $31,000 to $83,000 | $430 plus $1.75 for every $100 over $31,000 |

| $83,000 to $310,000 | $1,340 plus $3.50 for every $100 over $83,000 |

| $310,000 to $1,033,000 | $9,285 plus $4.50 for every $100 over $310,000 |

| Over $1,033,000 | $41,820 plus $5.50 for every $100 over $1,033,000 |

So, Is Stamp Duty Tax Deductible?

Purchasing investment property opens many doors when it comes to the tax breaks available to you. Knowing about these tax deductions will undoubtedly maximise your investment property returns.

While you may be able to claim various expenses associated with your investment property as tax deductions, unfortunately, stamp duty is not one of these tax-deductible expenses.

According to the Australian Tax Office (ATO), stamp duty is a capital cost related to the acquisition of your investment property. This means that stamp duty forms part of your property’s cost base and is consequently not tax-deductible.

The only exception to this is when purchasing an investment property in the ACT. When acquiring properties in the ACT, this is commonly done under a 99-year crown lease. This means that preparation and registration costs like stamp duty that’s incurred on the lease are deductible provided that the property is used or will be used to produce income.

Are There Any Stamp Duty Exemptions?

Certain circumstances may allow you to be exempt from paying stamp duty fees.

First Home Buyers

Some states waiver the stamp duty fee for first-time homebuyers up to a specific value. This is to encourage new homeowners and help them enter into the property market.

For example, in NSW, the government offers a “First Home Buyers Assistance Scheme.”

Eligible first-home buyers are generally exempt from paying stamp duty on newly built homes up to the value of $650,000.

However, from 1 August 2020, the NSW government has decided to temporarily eliminate stamp duty for first-home buyers purchasing a newly built home up to the value of $800,000.

If you are an eligible first-home buyer purchasing vacant land to build your PPOR, then you are generally exempt from paying stamp duty up to a purchase price of $350,000. In August 2020, this was temporarily increased to $400,000.

The first-home buyer eligibility criteria in NSW include:

- the purchaser must be an individual;

- he/she must be above the age of 18 years;

- he/she can’t be in a relationship where their spouse owns or has owned a property in Australia;

- he/she must be an Australian citizen; and

- he/she must occupy the property within 12 months of the purchase settlement or completion of construction, and it must be their PPOR for at least six consecutive months.

Transfer Between Family Members

If the property is transferred between family members due to death or divorce, the new owner will not be required to pay stamp duty upon transfer of the property.

Can Investors Recover Any of the Stamp Duty Fees?

Thankfully, the answer to this question is yes.

Stamp duty on the property transfer, along with conveyancing costs, can be claimed against Capital Gains Tax (CGT).

CGT is a tax you are required to pay on the profit made from the sale of your investment property. For more on CGT and how to reduce it, read here.

As these expenses form part of your investment property’s cost base, it can reduce the amount of CGT that you pay upon the sale of your property.

Example 2:

Jessica purchased a second-hand home in Sydney for $500,000 in August 2012. She is not a first-home buyer, so she is liable to pay around $17,500 stamp duty on the transfer of the investment property.

The conveyancing costs were around $2,750.

She decided to sell the investment property in 2020 for $770,00. The difference between her purchase and selling price is $270,000. For CGT purposes, she can deduct her stamp duty and conveyancing costs to reduce her total capital gain:

$270,000 – ($17,500 + 2,750) = $249,750

Consequently, Jessica is only required to pay CGT on her $249,750 capital gain.

If however, Jessica was a first-home buyer purchasing a new property, she wouldn’t need to pay stamp duty, provided that she resides in it as her PPOR for at least six months before using the property to generate an income.

Key Takeaways

In short, the answer to the question: is stamp duty tax-deductible – no it’s not. To avoid any expensive surprises when purchasing your investment property, it’s best to arm yourself with the knowledge of all the purchasing costs, such as stamp duty, that go beyond the purchase price of the property.

Unfortunately, the stamp duty costs are not immediately tax-deductible, but luckily for investors, there are ways to be exempt from paying stamp duty. For instance, if you are a first-time buyer purchasing a new home.

If you don’t meet the exemption criteria, you can offset the cost of the stamp duty against your capital gain when you sell the property to help reduce your CGT liability.

In some circumstances, getting a Stamp Duty Valuation may be required.

At Duo Tax, we can help you with this by producing what’s called a capital gains report that will factor in buying expenses to help increase your cost base so that you can reduce the amount of capital gains tax you pay. If you’re looking to sell your property soon, get in touch with us to purchase one today.

Beyond this, although stamp duty isn’t tax-deductible, there are many expenses that property investors can claim. As Quantity Surveyors, our team at Duo Tax can help you with tax depreciation schedules to help you save thousands on tax. To get a free estimate on your property, contact us today.

Ready to get started?

Talk to one of our friendly property experts to get a free quote or more Information.