As a property owner, you have several rights when it comes to objecting to the land tax assessment provided by the Valuer-General of your State or Territory.

While land tax is an inevitable part of owning property, you shouldn’t end up paying tax on an inflated land valuation.

Did you know that you can object against council land tax assessments by engaging a valuer to appraise your land independently?

We’ve created this guide to give you step by step instructions on how to lodge your objection if you feel that your land tax liability is too high.

What Is Land Tax?

Land tax is an annual tax payable on the unimproved value of the land that investors own.

Typically, you won’t have to pay land tax on your principal place of residence.

So, investment property owners, business owners and property developers will be responsible for paying land tax.

What Is Unimproved Value?

The unimproved value of the land is the value of the land without taking into account any improvements on the land such as:

- buildings;

- landscaping;

- paths; and

- fences.

The amount of land tax payable is dependent on the threshold of each state or territory.

For example, the following land tax threshold is set by the NSW Revenue Office:

| General Threshold | Premium Threshold |

| $100 + 1.6% of the value above the threshold, up to the premium threshold | $60,164 + 2% of the value above the threshold |

The thresholds for land values change each year:

| Tax Year | General Threshold | Premium Threshold |

| 2021 | $755,000 | $4,616,000 |

| 2020 | $734,000 | $4,488,000 |

| 2019 | $692,000 | $4,231,000 |

Where Can I Access Land Tax Rates?

You can access the different State and Territory land tax rates on the Revenue Office websites:

- Western Australia;

- Queensland;

- Tasmania;

- Victoria;

- Australian Capital Territory; and

- South Australia.

The Northern Territory is the only territory (and state) that doesn’t require property investors to pay land tax.

What Is a Land Tax Assessment?

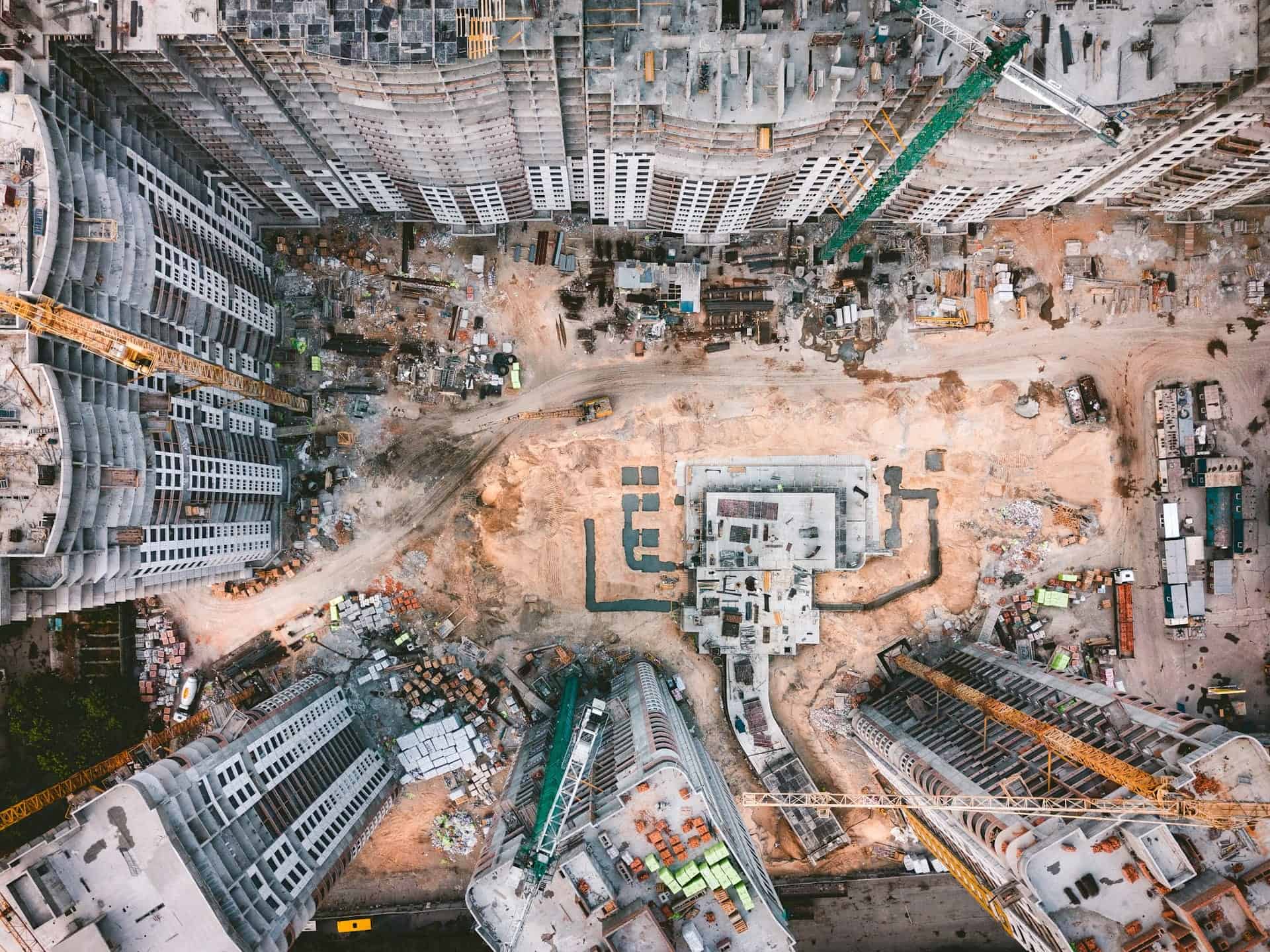

The Valuer-General of each State or Territory oversees the valuation process at the beginning of each financial year.

Generally, land tax valuations are undertaken on a mass valuation basis. This means that similar properties in the different districts are grouped together.

Each group will have a benchmark property that the Valuer-General uses to compare the other properties within the group.

When comparing the benchmark property to the rest of the properties in the group, the following considerations are taken into account:

- the size of the property;

- the property’s features;

- the surrounding location and infrastructure;

- zoning;

- heritage restrictions; and

- any nearby developments.

Each State and Territory has their own specific land valuation process, but generally, they follow the same mass valuation procedure.

So, it’s not uncommon to find that your tax liability doesn’t accurately reflect the property’s value – there is a margin for error.

The last thing you want to do is pay too much land tax, so each State or Territory’s Revenue Office does allow concerned taxpayers to lodge a land tax objection.

4 Steps To Valuation Objections

If you think that the valuation you received from the State Revenue Office is too high, you can lodge a land tax objection.

Here are the four steps you’ll need to follow:

Step 1: Before You Lodge An Objection

You’re going to need to provide the Valuer-General with supporting evidence as to why you object to their land value assessment.

So, you’ll need to gather data regarding the local property market when they conducted the valuation. The most useful information will be sales and information relevant to your property and area, such as:

- your property’s physical attributes;

- land use of your property as well as the surrounding properties; and

- any constraints.

You can’t simply look at the cost of properties for sale in your area.

To include relevant sales data, the following websites can give you access to property data and analytics across Australia:

Step 2: Lodge Your Objection

If you would like to object, all States and Territories require you to do so within 60 days of receiving your land tax assessment notice from the State Revenue Office.

Each Revenue Office website has a form that you’ll need to complete to provide reasons for the valuation objection:

- Victoria;

- New South Wales;

- Tasmania;

- Western Australia;

- South Australia; and

- Queensland;

- Australian Capital Territory.

Step 3: Objection Decision

Once you’ve lodged your valuation objection, the Valuer-General appoints an independent valuer to assess the original valuation and your objections.

The Valuer-General will review the independent valuer’s assessment or decision and make a final call whether to allow the objection in full or in part or whether to dismiss the objection.

In most States and Territories, you’ll have to wait to hear from the State Revenue Office within 90 days.

Suppose the land tax objection decision changes the outcome of your land tax liability. In that case, the Valuer-General will provide you with a reassessment, and you will either have to pay the outstanding amount based on the new assessment or receive a refund of the difference between your original assessment liability and the new tax liability amount.

Step 4: Appealing the Decision

If you’re not happy with the decision made by the Valuer-General, you can lodge an appeal.

Appeals are slightly more complex, so you’ll need to seek legal advice.

Can I Engage An Independent Property Valuer To Help Me Lodge An Objection?

Land valuations can be a bit of a complicated process – especially when it comes to gathering supporting evidence and establishing grounds to lodge an objection.

So, in certain circumstances, you should have a registered independent property valuer help gather all the relevant information and lodge your application on your behalf.

A property valuer can advise you on whether there are grounds to lodge an objection. If there are grounds and it makes sense to lodge an objection, a property valuer will:

- evaluate your property;

- gather relevant sales data;

- prepare objections; and

- lodge the land tax objection with the appropriate State Revenue Office on your behalf.

Key Takeaways

Paying land tax is an unavoidable part of your investment journey, so it’s worth knowing how it is calculated and how you can object to land valuations.

There are four steps to the objection process:

- gathering relevant sales data;

- lodging the objection within 60 days of receiving your land value assessment;

- waiting 90 days for the Valuer-General’s verdict; and

- appealing the outcome if you’re not satisfied.

If you decide to lodge an objection, you’ll need to provide reasons for the objection to the land tax assessment. Engaging the help of a registered property valuer will assist with this process.

At Duo Tax, we do not service this type of valuation. However, we do offer a full range of property valuation services across Australia.

Ready to get started?

Talk to one of our friendly property experts to get a free quote or more Information.