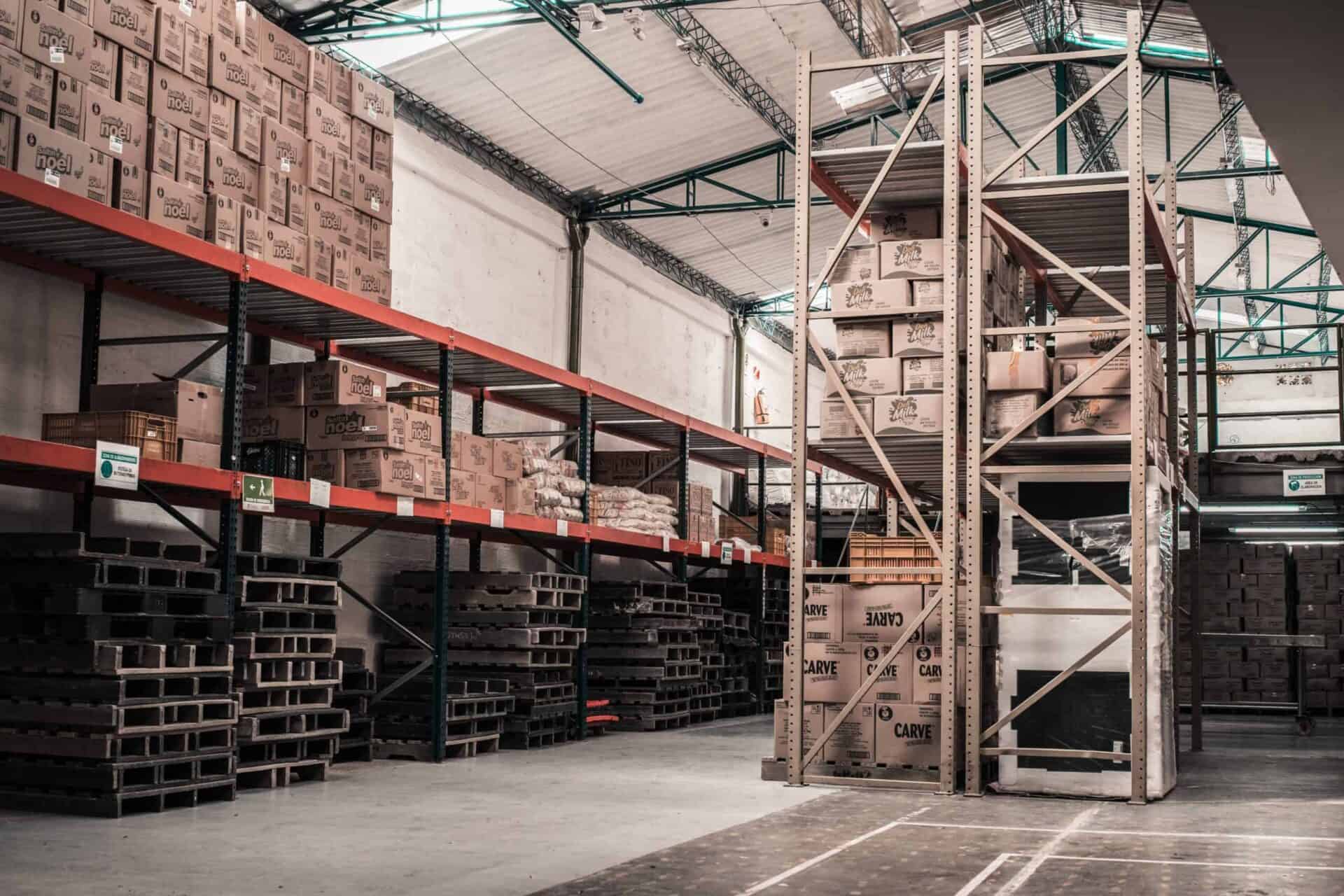

The Numbers: Steve’s Investment Property

Type of Purchase

Rent

Expenses

Commercial property owners can claim depreciation deductions for the building’s structure as well as any assets they own within their property. So Steve can claim depreciation on the plant and equipment (Division 40) assets that he owns and the offices’ capital works (Division 43) deductions.

Without Depreciation vs With Depreciation Services

The following cost breakdown shows Steve’s cash position with and without depreciation in his first year of owning the warehouse.

According to his Duo Tax depreciation schedule, Steve could claim $37,400 depreciation in his first year.

Steve’s numbers without a depreciation claim

Steve’s numbers with a depreciation claim of $37,400

Without depreciation, Steve was only generating $96 of weekly profit from his warehouse investment. However, by taking advantage of the Australian Tax Office’s tax breaks and making a depreciation claim, he started generating $420 each week – which is $324 more than before his depreciation claim.

This means that Duo Tax was able to save Steve a total of $16,830 in the first year of owning the warehouse.

The great thing about his depreciation schedule is that it’s valid for up to 40 years! So, Steve can continue saving money each year, as long as he continues to own the warehouse.

Here’s How Much You Could Be Claiming

However, if you’re still feeling unsure about committing to ordering a depreciation schedule, we have designed a tax depreciation calculator to help you estimate what you could potentially claim on tax depreciation.

This is an accounting tool designed to help estimate and calculate the declining value of capital works and plant and equipment assets and relies on accurate figures to present accurate estimations.

Obtain your tax depreciation schedule in 3 easy steps.