When it comes to claiming depreciation on your rental properties, two factors will be accounted for in a report. These are Division 40 (Plant and equipment) and Division 43 (Capital works).

Division 40 – Plant and equipment

What is Division 40 plant and equipment?

Plant and equipment refer to items that are fixtures and fittings, usually known as easily removable assets.

Each item has an effective life measured in years the ATO sets out. This can be found within the document ‘Taxation Ruling TR 2019/5 – Income tax: effective life of depreciation assets’.

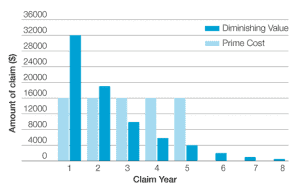

With Division 40 items, you can depreciate them using either the diminishing value or the prime cost method. Although the end value is the same, many individuals select the diminishing value method for depreciation as your items depreciate at a more rapid rate within the first few years.

For example, a dishwasher has an effective life of 10 years. It depreciates at a rate of 20% of its current value per annum until it reaches the value of less than $1,000. When the value is below $1,000 the depreciation rate increases to 37.5% (as per low-value pooling).

Low-value pool

A low-value asset is an asset that has depreciated over one or more years and now has a written-down value of less than $1,000, but only if you’ve previously worked out deductions for it using the diminishing value method.

You calculate the depreciation of all the assets in the low-value pool at the annual rate of 37.5%.

If you acquire an asset and allocate it to the pool during an income year, you calculate its deduction at a rate of 18.75% (that is, half the pool rate) in that first year. This rate applies regardless of at what point during the year you allocate the asset to the pool.

Immediate write off

Eligible plant and equipment items with a cost of $300 or less qualify for an immediate full deduction and have been applied accordingly in the calculations.

In contrast with the low-value pool, capital works items depreciate at 2.5% per annum over a 40-year period. For instance, if you repaint the building for $8,000 then the value of this figure will be evenly depreciated over a 40-year period, equating to $200 per annum. Thus, there is a clear distinction between these two elements of depreciation.

As depicted above, this is the depreciation of an asset worth $80,000 with an effective life of 5 years. It is quite significant that utilising the diminishing value method yields more tax deductions within the first few financial years.

Some examples of Division 40 items are:

- Air conditioning unit

- Blinds

- Carpet

- Light shades

- Oven

- Rangehood

- Ventilation fan

With the ruling from the Federal Budget of 2017, we have witnessed several changes:

Income tax deductions for the decline in value of previously used plant and equipment in rental premises used for residential accommodation are no longer allowed. The changes are now law.

Related Article: ATO opening doors to huge instant asset write-off for more businesses than ever

The changes apply from 1 July 2017 to:

- previously used plant and equipment acquired at or after 7:30pm on 9 May 2017 unless it was acquired under a contract entered into before this time

- plant and equipment acquired before 1 July 2017 but not used to earn income in either the current or previous year.

- These changes are only applicable to residential property investors and purchased under an individual or self-managed superannuation fund.

Investors who purchase new plant and equipment will continue to be able to claim a deduction over the effective life of the asset. Along with this, any ‘substantial renovations’ to the building will be treated as new premises and will be able to claim both aspects of depreciation.

This ruling does not affect Division 43 – Capital Works or any non-residential properties.

Division 43 – Capital Works Deductions

Division 43 – Capital works refer to the depreciation of the structure of the building, usually objects that aren’t removable.

Capital works include:

- Buildings or extensions

- Alterations or improvements to a building

- Alterations or improvements to a leased building

- Structural improvements

- Earthworks for environmental protection

Capital works may also be known as Building Write-Off or Capital Works Allowance.

Residential properties built after the 15th September 1987 are eligible to claim division 43 capital works deductions over a 40-year period which will be depreciated as a straight line at 2.5% per annum. When construction costs are unknown, a qualified specialist such as a Quantity Surveyor will be responsible for estimating the building.

Examples of capital works are:

- Driveways

- Fencing

- Garage

- Paint

- Roofing

- Tiling

- Walls

Despite division 43 capital works being specifically for deductions with residential properties, you are also entitled to claim depreciation on other buildings that are utilised for other purposes. Such examples are buildings used as an office, warehouse or accommodational purposes. The deduction rates applicable varies between buildings and can be found via the ATO.

Additionally, preliminary expenses such as surveying and engineering feeds are also factored in a capital works schedule.

At Duo Tax Quantity Surveyors, we recognise the importance of correctly differentiating the items into its rightful category to ensure you are entitled to the maximum tax deductions.

Ready to get started?

Talk to one of our friendly property experts to get a free quote or more Information.