Commercial real estate is a great investment for people who are looking to diversify their portfolios. However, there are some things that you need to consider before buying commercial property.

For example, you need to consider factors such as the physical condition of the property, strategic location, investment goals and current budget. But, sometimes, investors forget also to consider whether or not the property is already tenanted.

More often than not, the terms of the contract of sale between yourself and the seller will dictate that if your new property has an existing tenant, you are bound by the existing lease. However, existing leases aren’t necessarily a bad thing because they offer the opportunity for stable rental returns and lucrative tax deductions.

So, here’s what you need to know (and do) when buying a commercial property with existing tenants.

Investing in Commercial Property

While many investors may perceive buying commercial property as a higher risk because of the fluctuating market and recent economic turbulence, there are several benefits to investing in commercial property.

For example, the primary benefit of commercial property investment is that it promises higher returns due to:

- higher yields and cash flow: commercial rental yields are anywhere between 5% and 12%, and higher yields equal more potential for positive cash flow,

- rental income stability because leases are longer,

- annual rent increases: the majority of commercial property lease agreements contain a fixed rental increase clause, and generally, the increases are higher than inflation, ranging between 3% and 4%, and

- tax benefits: you can save thousands of dollars in depreciation tax deductions.

But, there are also several other factors to consider, such as the stricter mortgage terms, GST implications and complex leases.

For more information and factors to consider, make sure to check out this complete guide to buying commercial investment property.

What If the Commercial Property Has an Existing Tenant?

While there are several considerations that need to be factored into your decision to purchase commercial property, it’s also important to consider whether or not the commercial property you’re interested in purchasing already has an existing tenant.

Purchasing property that is already leased can be beneficial for investors who aren’t looking to change its current purpose. In other words, they’re not looking to make any significant changes or refurbishments that may change what the building is currently being used for. So, for example, they’re not looking to convert the commercial space from retail to restaurant.

The biggest benefit and the most obvious reason why investors like already tenanted spaces is that they have the opportunity to generate rental income from the get-go without the hassle of looking for tenants and the risk of having a vacant property.

Investors also have quite a bit of insight when it comes to assessing the future viability of the commercial property and its potential future returns.

However, not all tenanted circumstances lead to ideal outcomes. For example, buying a property with an existing lease agreement is not ideal if the rental rate is not competitive in the current market or if the fixed rental increase clause will be detrimental to the future growth of your investment.

And unfortunately, if the existing lease forms part of the contract of sale, it can be very difficult to negotiate its terms. So, it’s important to do all the necessary due diligence on the property, the tenants and the likelihood that your investment will perform in your favour.

If you are looking to purchase an already-tenanted commercial property, you must seek legal assistance when it comes to interpreting the terms of the contract, the flexibility to negotiate terms and how you may be able to end the lease.

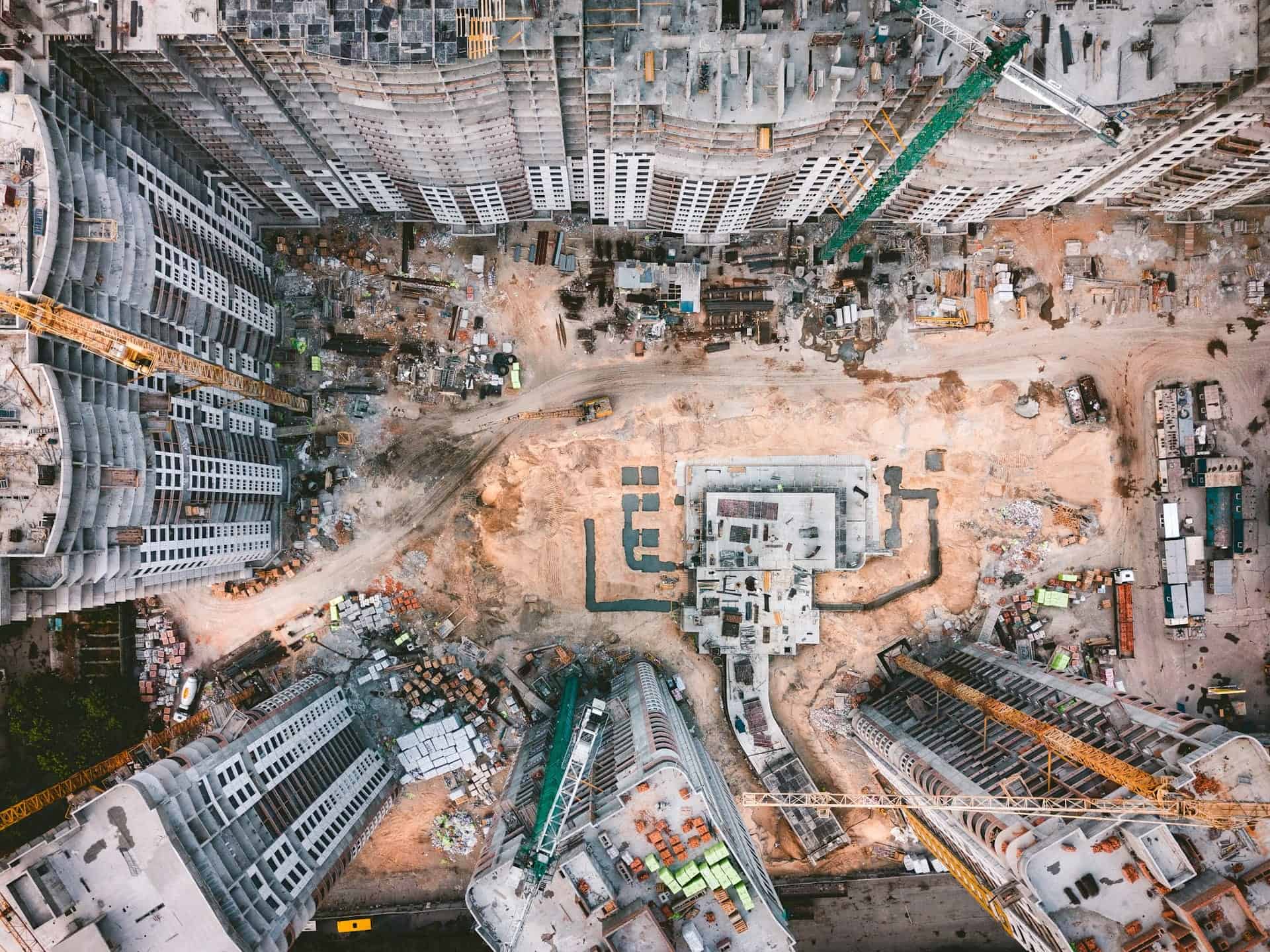

Is a Tenant Required to Remove Existing Fit Out?

Suppose you’ve purchased a commercial property with an existing tenant, and the lease period is coming to an end. In that case, if the tenant has installed assets during a fit-out, you may need to return them to the tenant.

However, this is entirely dependent on what the lease stipulates.

For example, if a commercial tenant vacates the property and doesn’t remove the fit-out that they installed during the duration of their lease, and the lease doesn’t stipulate that the assets must be returned, you may be able to claim the remaining commercial property depreciation for the items.

How Can Duo Tax Help

If you have opted to purchase a commercial investment property with an existing tenant, you may want to consider getting in touch with a Quantity Surveyor to help you navigate your depreciation claim.

Claiming depreciation on commercial properties is interesting because there are substantial tax benefits for both commercial property owners and tenants. Understanding what you are allowed to claim can save thousands of dollars each year.

Commercial property owners can claim depreciation deductions for the building’s structure (Division 43 assets) and any assets they own within their property (Division 40 assets). On the other hand, commercial tenants can claim tax depreciation deductions for any assets they purchase and install during a fit-out.

Claiming your tax-deductible expenses involves identifying the value of a property and all its fittings and fixtures that you own. The purpose of a tax depreciation schedule is to outline the value of both your Division 40 and Division 43 assets, as well as how much it has depreciated and will depreciate. This will give you a clear idea of how much you can claim.

A depreciation schedule is a major advantage for commercial property owners and tenants to boost their cash flow by maximising the tax depreciation deductions.

So, if you’re a commercial property owner (or tenant) get in touch with a Duo Tax specialist Quantity Surveyor to see how much you can save each year.

Ready to get started?

Talk to one of our friendly property experts to get a free quote or more Information.