Investing in property can be an excellent way to build wealth and generate passive income, but you need to remember that owning a rental property also comes with financial responsibilities.

One of these responsibilities is managing your tax liability effectively, and many property investors overlook a crucial tool for doing so: depreciation.

Depreciation allows you to claim the decline in value of your property over time as a tax deduction, but without a properly-prepared depreciation schedule from a qualified quantity surveyor, you may miss out on thousands of dollars in potential tax savings.

In this article, we’ll explore what you can expect from your investment property depreciation schedule and why working with a professional is essential to maximise your tax benefits.

What is Property Depreciation?

Property depreciation is a tax deduction that property investors can claim for the decline in the value of their rental property over time.

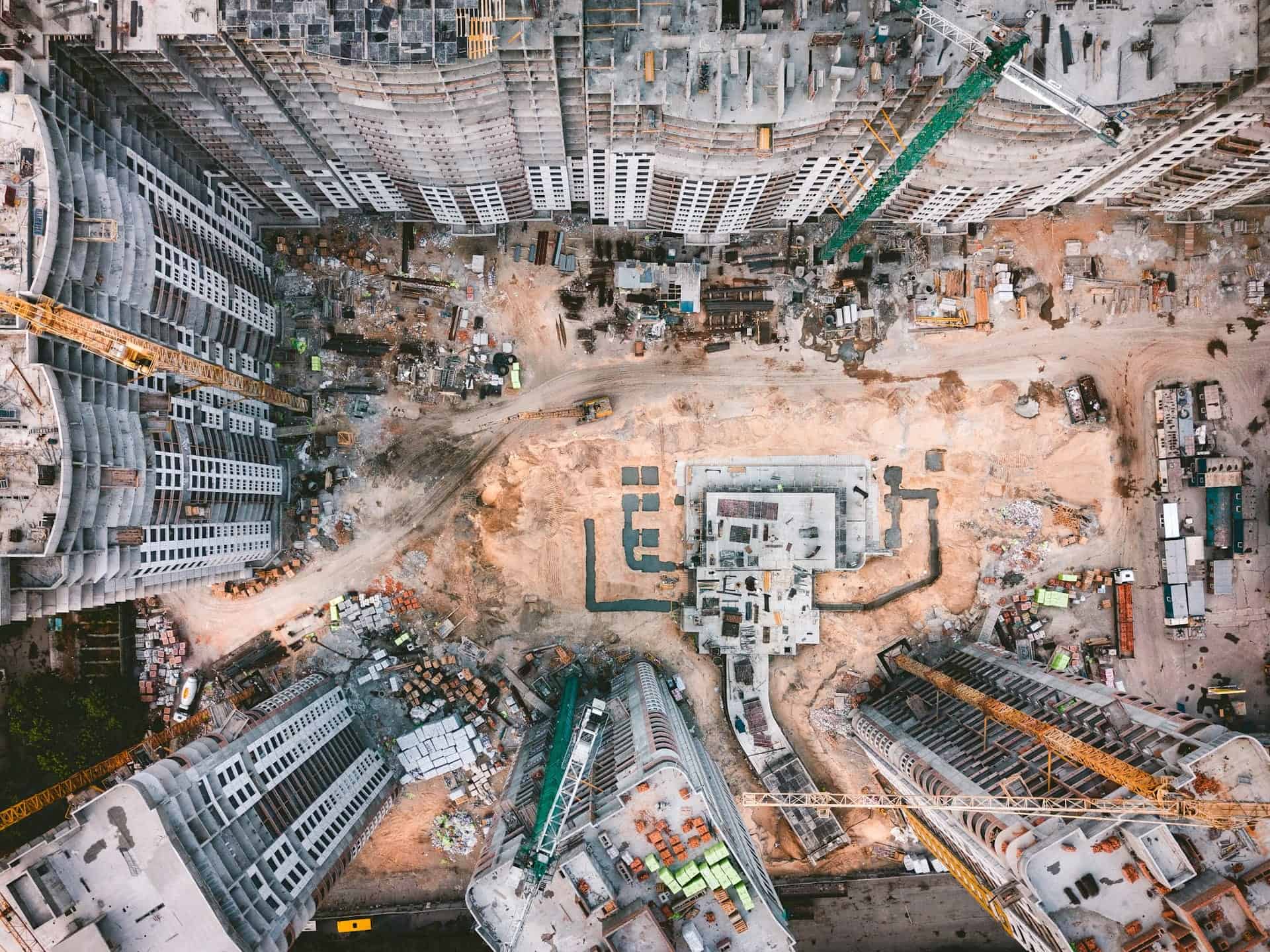

Investors can make two types of depreciation claims: capital works and plant and equipment.

Capital works deductions cover the building’s structural components, such as walls, floors, roofs, and foundations. Plant and equipment depreciation, on the other hand, covers removable assets such as appliances, carpets, and air conditioning systems.

The Australian Taxation Office (ATO) sets the rules for claiming depreciation, and it’s important to ensure that your claims comply with these guidelines. For example, you can only claim capital works depreciation for buildings built after September 1987, while plant and equipment assets have varying effective lives and depreciation rates.

For a more detailed explanation of depreciation on investment properties, check out our Property Tax Depreciation Guide.

Why Do You Need to Order an Investment Property Depreciation Schedule to Submit Your Tax Deductions Claim?

To claim depreciation deductions on investment properties, you need to accurately identify the value of the property and all its assets.

How do you calculate depreciation on an investment property? This is where a qualified Quantity Surveyor comes in.

Quantity Surveyors

Quantity Surveyors are construction professionals with specialist skills in estimating the costs of construction and the value of fixtures and fittings. The ATO recognises Quantity Surveyors as expert professionals for compiling a property depreciation schedule, and the ATO widely accepts their reports as evidence for tax claims.

What Can You Expect from your Investment Property Depreciation Schedule?

Getting a tax depreciation is relatively straightforward and typically begins with the quantity surveyor gathering some basic information about you and your property, including the address, date of purchase, and any renovations or improvements made to the property.

They will also ask about the property type and its use, such as whether it is residential or commercial.

Next, the Quantity Surveyor will inspect the property to identify all depreciable assets and calculate their value and expected lifespan. This inspection is a critical step in the process as it ensures that all the assets are accounted for and that the depreciation calculations are accurate to claim tax deductions.

Once the inspection is complete and they have an estimate of the construction costs, the quantity surveyor and their tax team will review the information gathered and prepare the depreciation schedule.

The report will outline the following:

- Glossary of terms to help you understand the various components and terminology involved in the report

- A 40-year breakdown of all the Division 43 (capital works) items that you can depreciate.

- The effective life and prescribed depreciation rate for all Division 40 (plant and equipment) assets

- Calculations using the prime cost and diminishing value depreciation method to help you choose the most appropriate method for your specific circumstances

- A breakdown of the assets that qualify for an instant-asset write-off and those you can add to low-value pools. This will help you identify the assets you can claim in full as an instant deduction or those you can pool together for a lower depreciation rate.

Finally, the Quantity Surveyor will provide you (and your accountant) with the completed depreciation schedule, which you can use to claim your deductions on your tax return. The schedule is valid for up to 40 years from the original date of construction, and a Quantity Surveyor can incorporate any updates or changes to the property into a revised schedule.

Should You Get a Tax Depreciation Schedule?

If you own an investment property, consider getting an investment property depreciation schedule to help you maximise your tax deductions.

Let’s look at how Duo Tax helped a client save thousands of dollars on her investment property tax return.

Our client purchased a brand-new townhouse for $720,000 and began renting it out six months after purchasing it. Her yearly rental income amounted to $28,080, while the property’s expenses amounted to $38,522.

Our client lived in the property for six months before renting it out, which meant she couldn’t claim deductions for plant and equipment assets, as per the ATO regulations for properties purchased after 2017. However, she could still claim capital works, such as the building itself.

So, according to her Duo Tax depreciation schedule, our client could claim $9,000 depreciation in her first year.

Being negatively geared, our client could already offset her assessable income with that loss, but claiming depreciation helped her offset her income with a greater amount.

Her total tax loss (including depreciation) amounted to $19,422, and with a 37% marginal tax rate, she could reduce her taxable income by $7,194.

This, in turn, lowered the cost of her investment from $6,578 to $3,248 per year, which is a $3,330 savings.

Our client’s experience demonstrates how an investment property depreciation schedule can benefit investors. Without it, she may have missed out on claiming depreciation on her property and couldn’t reduce her taxable income.

The fees for obtaining a depreciation schedule from a qualified Quantity Surveyor are tax deductible, which means you can claim them on your tax return. It’s also worth noting that you generally only need to order a depreciation schedule once, as it is valid for up to 40 years.

Key Takeaways

If you’re an investor, a depreciation schedule can be an incredibly valuable tool for reducing your tax liability and improving your cash flow. While the cost of obtaining a depreciation schedule may seem daunting, the benefits can be significant and long-lasting.

Ready to order your investment property depreciation schedule?

Contact Duo Tax Quantity Surveyors today to speak with one of our qualified experts.

With years of experience and a team of qualified professionals, Duo Tax can provide an accurate and compliant depreciation schedule that maximises your tax savings. Feel free to get in touch with Duo Tax to learn more about their services and how they can help you save money on your investment property.

Ready to get started?

Talk to one of our friendly property experts to get a free quote or more Information.